Click Here to View This Page on Production Frontend

Click Here to Export Node Content

Click Here to View Printer-Friendly Version (Raw Backend)

Note: front-end display has links to styled print versions.

Content Node ID: 404815

The Covid pandemic’s initial impact in the spring of 2020 constituted an unprecedented shock to the global industry, and ever since the recovery path has been hard to chart. At the request of AIN data analytics specialist Spire Aviation generated data from its own constellation of more than 110 satellites to track the number of flights operated by six international carriers between January 2020 and the end of May 2021. The variations in their fortunes are striking, reflecting wide differences in Covid’s continuing impact, governmental responses, and, very likely, societal attitudes toward the risk from travel.

Air China has fully restored pre-pandemic levels of flight activity, hitting a year-to-date peak of almost 40,000 flights in April. In the U.S., United Airlines has yet to completely reverse its descent but has achieved a mainly steady recovery to reach almost 54,000 flights in May after hitting some new turbulence around September 2020 and February 2021.

In Europe, where new waves of Covid infection and vexatious switches in restrictions have been more challenging, Lufthansa remains at less than half of its pre-pandemic activity levels. In May, it operated just under 12,000 flights, having never pushed above a monthly total of 16,000 since the nadir in April 2020.

Qatar Airways and Air New Zealand closely tracked each other’s dispiritingly static traffic levels in the low five figures, never breaking through the clouds at around the 15,000 mark. Worse still is the situation for Singapore Airlines, which has essentially flatlined for almost 14 months, seemingly unable to generate more than a paltry 5,000 monthly flights.

According to Spire Aviation general manager Shay Har-Noy, who is an economist by background, there is still no clear understanding of what the long-term impact of Covid will be on the air transport sector. He views the key variables going forward as being inconsistent rates of vaccination in countries around the world and possible lasting changes to demand for travel for work purposes. What’s more, he also feels that conditions for airlines could get harder before they get better as government Covid relief measures are phased out and businesses face the very real prospect of rising interest rates to counteract anticipated inflation.

Har-Noy told AIN that airlines are still facing hard choices over how to optimize the composition and utilization of their costly fleets. “It costs a ton to keep aircraft on the ground, no-one likes it on their balance sheet not generating revenue,” he commented. “But if you can’t count on consistent passenger volumes you are going to try getting them off your balance sheet, you’re going to try changing your leasing arrangements, you’re going to try to not take delivery of new aircraft. It’s now less about optimizing the marginal cost and more about how you can utilize your fixed costs on a per passenger basis.”

In theory, explained Har-Noy, airlines would be better off if airlines could rapidly deploy different-sized aircraft to any given route on any given day according to shifting demand levels. “However, the amount of fixed cost overheads associated with that prevents that approach. But a mixed fleet strategy is a necessity,” he said.

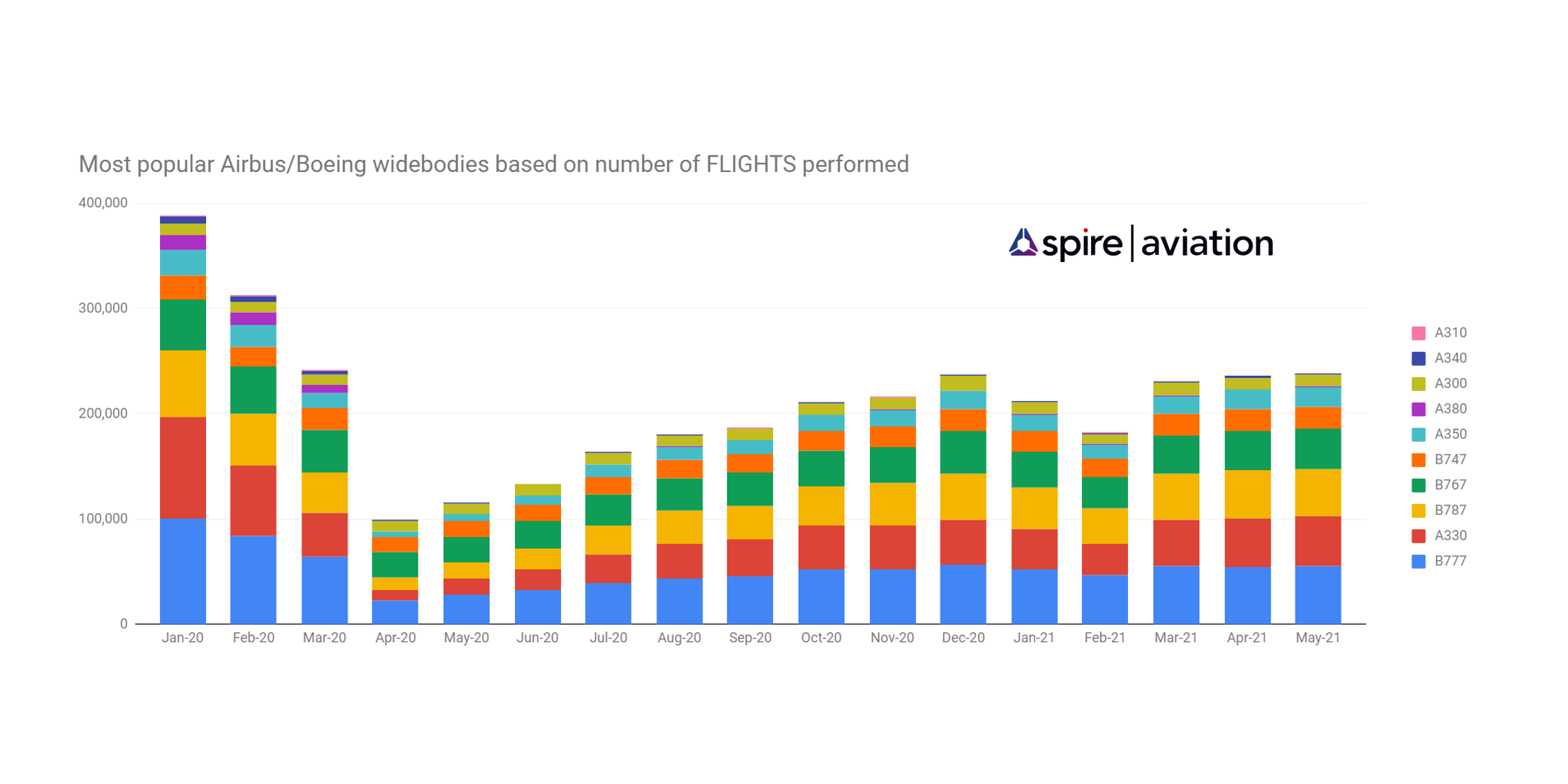

Spire Aviation, which is part of data and analytics group Spire Global, also logged numbers for widebody airliners in service from January 2020 through the end of May 2021. The data shows which of the various Airbus and Boeing types have been most and least active in a long-haul sector where Covid has most severely affected demand.

Since the start of the pandemic, the ubiquitous Boeing 777 has consistently led the twin-aisle pack. The A330 and the 787 Dreamliner have run almost head-to-head, after outstripping activity levels for the aging 767.

Covid has clearly accelerated the venerable 747’s long-anticipated retirement wave. Perhaps more surprisingly, numbers for the far more modern A350 stayed low, while the A380s and A340s flatlined too. According to Har-Noy, airlines will naturally gravitate to using twin-engined aircraft in preference to four-engined types whenever possible, describing them as the industry’s “robust workhorses.”

Bucking the overall trend to some extent is the fact that the numbers of older A300/310 jets remaining active through the pandemic was not as severely impacted. “It’s interesting to note very limited change in A300/310 statistics, since most of the type is used for air cargo and military applications, respectively,” commented Spire’s technical product manager David Manda.

The pandemic’s effect on the activity of widebody airplanes in the category of the A380 and 747 reflects continuing stagnation of international markets. Of course, the relatively strong resurgence of domestic flying, particularly in China and the U.S., disproportionately has accounted for what recovery the industry has seen so far.

According to Spire, Southwest Airlines has now recovered to around 80 percent of pre-Covid volumes, while Air China is close to 100 percent. However, it reported that in Europe as of late June, Lufthansa was still trapped at around the 30 percent mark.

At the same time, the Middle East and South America have lagged all other regions. “South America and the Middle East are sort of competing for the slowest recovery,” said Mark Duell, vice president of FlightAware, which also tracks airline activity worldwide. The Middle East, where the big Gulf carriers Emirates, Etihad, and Qatar Airways rely almost exclusively on international traffic, has seen a steady flight volume of about 50 percent of pre-pandemic traffic levels since the start of this year. Similarly, South America sits at about 55 percent following a slip by the end of the first quarter to roughly 40 percent of pre-Covid levels as border closures stalled international traffic and Brazil’s persistently high Covid rate hit domestic travel in one of the biggest markets in the region.

Overall, even as flight volumes have begun to return with higher vaccination rates in certain regions, load factors remain “very poor,” said Duell, as airlines vie for market share and add flights pre-emptively in anticipation of traffic returning. “Anecdotally, we’ve seen stories about one passenger flying back from India in a 777,” he noted. “A fair bit of it is also belly cargo, as the air freight market is very strong right now…Emirates is not flying that 777 to India for one person; they’re flying it with a belly full of cargo.”

Considering the uneven recovery, Duell said industry leaders have begun to show more optimism lately. In the U.S., for example, all the major airlines have said they’ve begun to recall staff and plan to reactivate all their idle airplanes by the end of the year. In places with small domestic markets and vaccination rollouts remain slow, the situation appears far less encouraging. “It may be quite a while before movement gets back to normal [in those places],” concluded Duell.

AIN interviewed executives from Spire Aviation about the impact of Covid on the air transport sector and how they view prospects for recovery. You can watch that video here.