Click Here to View This Page on Production Frontend

Click Here to Export Node Content

Click Here to View Printer-Friendly Version (Raw Backend)

Note: front-end display has links to styled print versions.

Content Node ID: 414138

In its third annual Business Jet Market Forecast—released on Monday at EBACE 2023—Global Jet Capital expects continued growth for the next five years in preowned business jet transactions and new deliveries. But that is tempered by what it characterizes as a “leveling off from the unprecedented demand that our industry experienced post-pandemic.”

The news isn’t bad for the business aviation market, according to chief marketing officer Andrew Farrant. “Most OEMs have strong backlogs and should see improvements in supply-chain challenges that limited deliveries in 2022 and so far in 2023. Preowned transactions continue to return to rates more in line with historical trends and are expected to pick up in 2024 and beyond to reflect increasing demand from new aircraft models.”

In 2023, the forecast expects new and preowned transaction unit volume to drop 2.6 percent while transaction dollar volume should climb by 1 percent. This is due to more demand for larger jets and new-production jet deliveries growing 6.3 percent and dollar volume by 12.2 percent in 2023, according to Global Jet Capital.

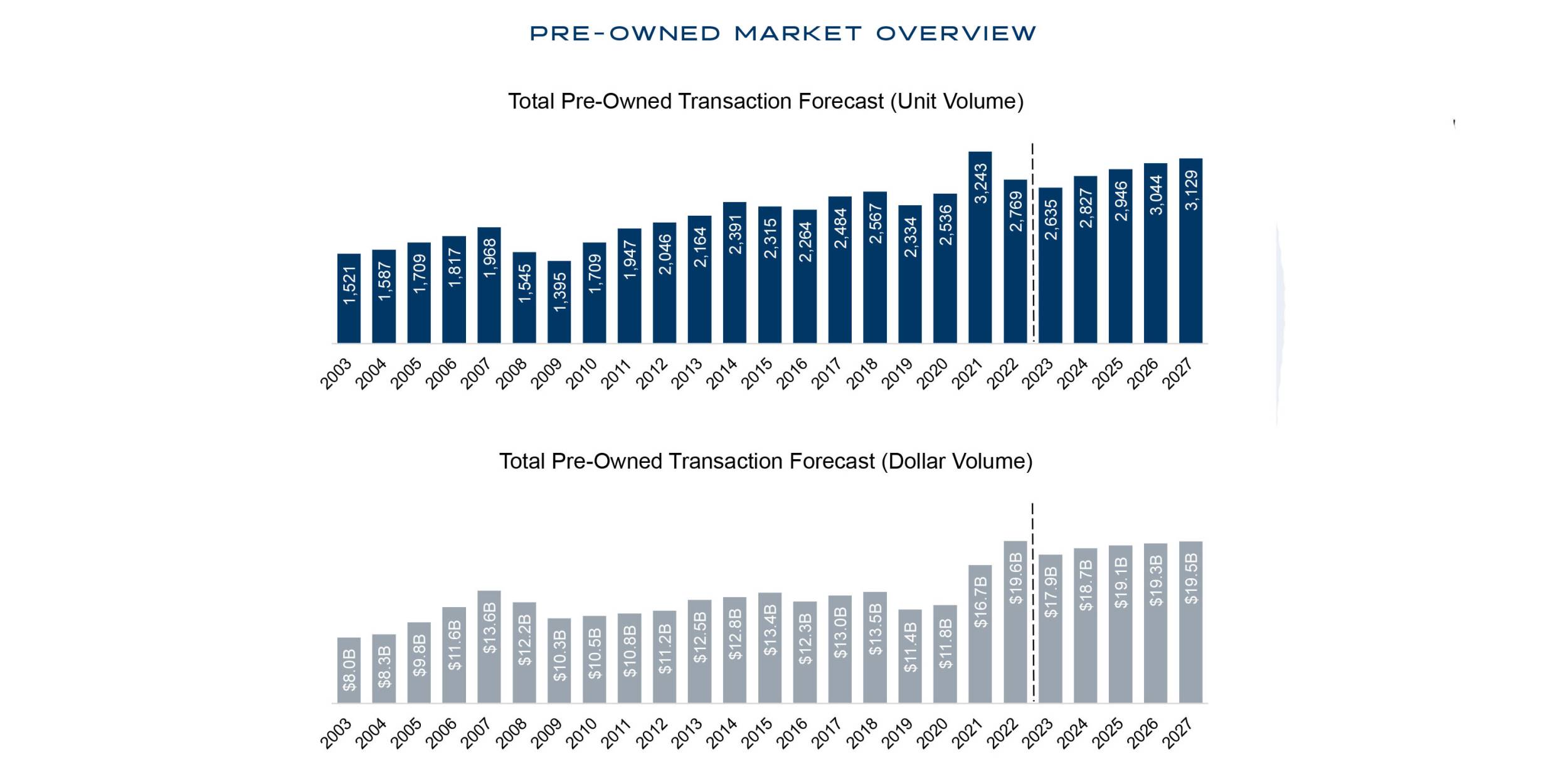

On the preowned side in 2023, unit volume is projected to drop 4.8 percent and dollar volume 8.5 percent.

The forecast through 2027 predicts a reemergence of historic trends of steady growth, with transactions—new and preowned—growing at 2.9 percent per year and dollar volume up 3.1 percent. “Between 2023 and 2027, we forecast new aircraft will represent 51.5 percent of the total value of the market, about on par with the last five years,” the forecast noted. New aircraft deliveries should reach 893 in 2027, up from 712 in 2022, with all jet categories seeing an increase, led by heavy jets at 282. Very light jets will account for 202, light jets 210, and medium jets 199.

From the peak of 3,243 preowned transactions in 2021, unit volume is expected to grow again from a 2023 low of 2,635 to 3,129 in 2027.

“The last couple of years have been kind of exceptional,” said Global Jet Capital CEO Vivek Kaushal. He admitted that the Global Jet Capital model missed forecasting what happened during and after the Covid pandemic. “If the model predicted what happened in the last couple of years, I would be worried that we have some strange kind of model,” he said. But overall, “the model has back-tested very well each year.”

While prices for materials remain high and maintenance costs continue to climb, people are still buying business aircraft. “Our view on the market is what we’re seeing is a natural pullback," he said, "something that is a reflection of the exceptional time the industry has enjoyed for 2021 and 2022. We’re gradually and systematically retreating from those peaks. We’re not seeing a level of distress.”

Unlike the wild runup to the 2007 to 2009 recession, when banks loaned money on aircraft with ever-increasing values and with a high amount of leverage, Kaushal said, “That didn’t happen this time.” Banks are much more conservative and buyers aren’t trying to over-leverage their aircraft purchases.

With the influx of many new entrants to business aviation, there will be some buyers who elect to sell and their aircraft will come onto the market. “But if we look at the pace of aircraft that came on the market in 2009, we’re not seeing them come on the market like that now,” he said. “Fundamental drivers” such as the overall expansion in the user base and pent-up demand will help maintain a strong level of activity. “A lot of wealthy people want to use private aviation to travel,” he added.

Aircraft manufacturers are also being more disciplined about manufacturing to meet the needs of the marketplace and not overbuilding, Kaushal explained. “They’ve done a tremendous job managing through the supply chain challenges.”

Overall, he concluded, “This is a more kind of a natural pullback, and the industry is going to have to work through it. I get the sense that everybody is taking it in stride, so there’s not any kind of stress.”