Click Here to View This Page on Production Frontend

Click Here to Export Node Content

Click Here to View Printer-Friendly Version (Raw Backend)

Note: front-end display has links to styled print versions.

Content Node ID: 404857

Additive manufacturing continues to proliferate across the aerospace sector as leading OEMs and their suppliers find new ways of tapping the flexibility—as well as cost and weight savings—that the approach can deliver. Increasingly, the techniques, which in some cases entails 3D printing where objects are made by building layers from either metal powder or composite materials, have become more competitive with castings for smaller parts. As the technology matures, including for both materials and machines, manufacturers will increasingly apply it to making larger components and structures too.

“Both the technology and our confidence in it is improving,” Eric Gatlin, GE Aviation’s additive manufacturing leader, told AIN. “Our forward trajectory now is to use additives wherever it differentiates a product in terms of weight and design.”

For the U.S. group, that now means using additives to make components such as the fuel nozzles for the Leap turbofans it makes through its CFM International joint venture with French aero engines group Safran. Similarly, on each GE9X engine, additive manufacturing now delivers no fewer than 292 parts, which Gatlin said represents a big increase over past practice. The company’s new Catalyst general aviation and business aircraft engine also will feature significant additive content.

The GE Aviation team works closely with colleagues from the group’s GE Additive unit, which the group established in October 2016. “This approach is continuing to drive down costs and improve the robustness [of the design and manufacturing process],” said Chris Schuppe, GE Additive's general manager for engineering and technology. “It is increasingly part of the [GE Aviation] engineers’ vocabulary and we find we no longer have to fight to do it [additive manufacturing] because it’s an accepted part of the process.”

In part, greater flexibility in designing components seems to have won over engineers to additive manufacturing. According to Schuppe, the processes have “opened the aperture very wide” to allow designers to be more creative and not feel so constrained by the limitations of castings.

With growing confidence to switch from using traditional casting molds, GE has challenged companies in its supply base to ask itself which items they can now make through 3D printing or other additive techniques. “We’ve challenged ourselves and our partners over the cost savings we can achieve,” said Gatlin. “With Covid, we had some extra bandwidth [due to reduced rates of manufacturing] and so this gave us time to put an aggressive plan together, challenging ourselves to do this [switching to more additive manufacturing] in less than a year.”

Already, the company’s expansion of its additive manufacturing portfolio is yielding significant production flexibility benefits. Much of the momentum comes from GE’s development center in Cincinnati, Ohio, with low rates of production at its U.S. plant in Auburn, Alabama, and at another site in Italy. “It’s giving us great business continuity and greater commonality in our production process around the world,” said Gatlin.

For rival aero engines group Rolls-Royce, 2015 marked a significant milestone in its transition to additive manufacturing, when it used the process to make large titanium aerofoils for the Trent XWB-97 turbofans. According to the UK-based group, the 1.5-meter diameter structure was the largest load-bearing structure to have flown on a commercial airliner when it first powered the Airbus A350 widebody airliner.

According to Neil Mantle, Rolls-Royce’s director of manufacturing, the group knew then that additive manufacturing held far more potential. “We realized that we needed to know even more about it and use the geometric freedom it gives you to make things you can’t do by any other means,” he told AIN.

The group’s current state-of-the-art achievement in this field is the Pearl 10X engine, which it developed for Dassault Aviation’s latest Falcon 10X business jet. It will increasingly apply the breakthrough technology to its larger airliner powerplants, said Mantle.

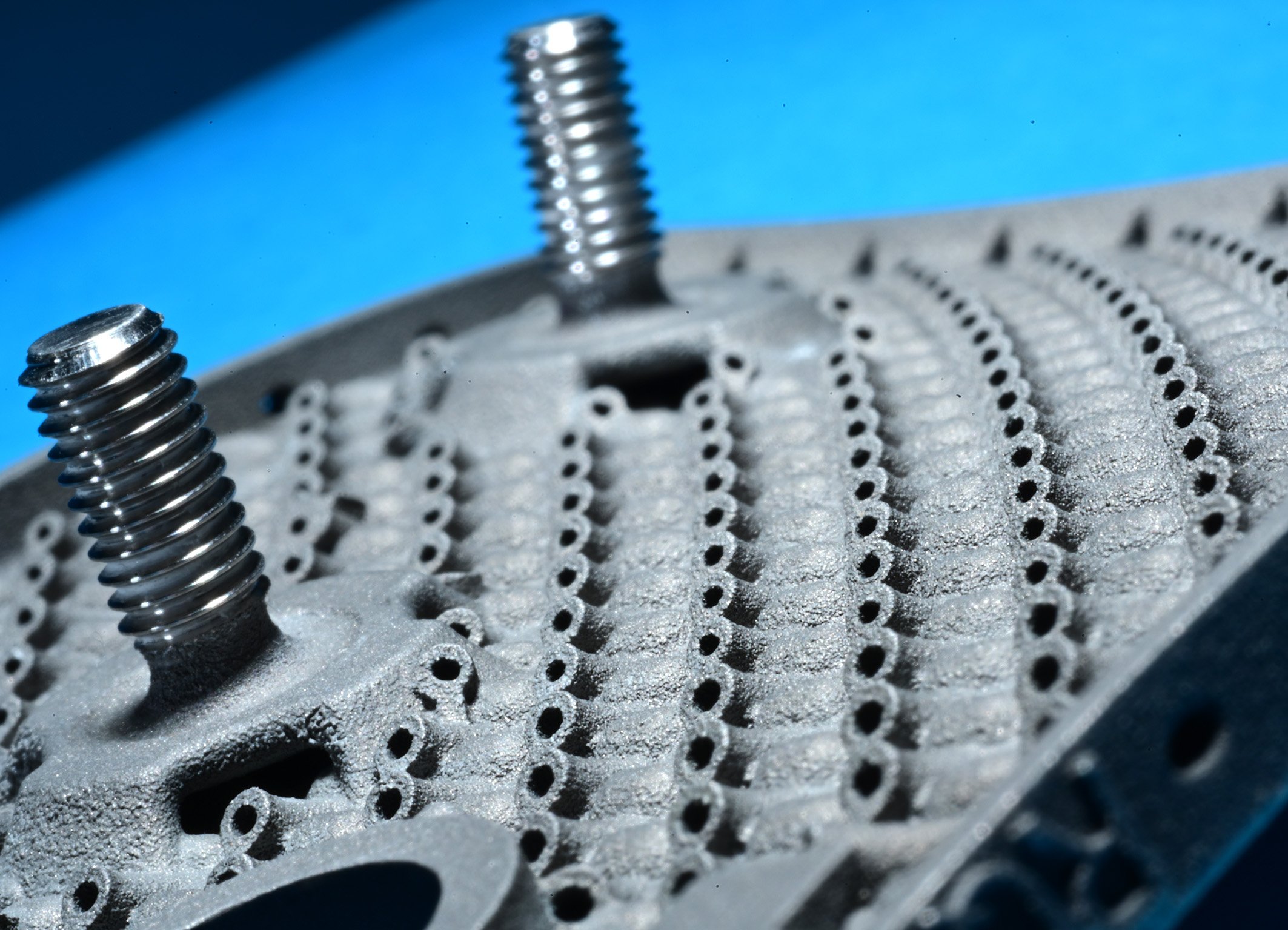

The Pearl 10X features a low emissions combustor developed as part of Rolls-Royce’s Advance 2 technology initiative. The combustor consists of 3D printed tiles made in machines with four lasers that can melt four sets of tiles simultaneously.

For previous engine combustors, engineers would have made the tiles by casting and then drilling holes into them. “That meant we were very limited with regard to the geometrics of the tiles, but now we are completely free to define what we want to do with them,” explained Philipp Zeller, senior vice president for the Pearl 10X.

The use of 3D printing has meant that more complex components can be made without wasting materials. In the case of the Pearl 10X combustor, the process delivers additional environmental benefits by reducing the need for cooling air usage. The new unit includes cooling holes that optimize the flow of cooling air and reduce nitrous oxide emissions through an improved air mixing process. The new design also has reduced the number of temperature hotspots in the combustor, enhancing the performance of the engine’s high-pressure turbine.

At Rotherham in the north of England, Rolls-Royce has invested in a dedicated additive manufacturing facility. The team there is working on industrializing the technology to apply it to the group’s wider production process. Overall, the company believes its switch to the new processes could reduce the time taken to design and manufacture components by as much as 75 percent.

Looking beyond the Pearl 10X, Rolls-Royce now intends to use additive manufacturing for components in the new UltraFan engines, including the turbine bearing hub. Those additive components will be even larger than those on the Trent XWB-97.

Stratasys, a leading manufacturer of 3D printing machines and additive materials, also has seen aerospace OEMs increasingly embrace additive manufacturing processes as part of the mainstream supply line. “It has shifted from something that used to be seen as quite an experimental technique to something that is just part of everyday procurement for companies like Airbus that are now using it right across their platforms, including the A350,” Scott Sevcik, vice president of the U.S. company’s aerospace business, told AIN.

The Stratasys printers use specially developed polymer resins such Ultem and Antero, which can deliver significant weight savings in place of aluminum. Those materials increasingly have come into use in the production of components for aircraft cabin interiors. Lately, the company has introduced new vat polymerization techniques, better suited to higher-resolution 3D printing for smaller parts.

According to Sevcik, companies throughout the aerospace supply chain are adopting additive manufacturing, from major engine and systems makers like Safran to specialists like UK-based Senior Aerospace BWT, which is making air ducting systems with a pair of recently-delivered Stratasys Fortus 450mc printers.

One of the latest trends in the field centers on the addition of carbon fiber to polymers to increase strength. In some cases, materials developers are adding elements such as flame retardants and additives that make it easier to make small parts not well suited to traditional extrusion processes such as connectors.

In Sevcik’s view, additive manufacturing also holds the potential to drive cost efficiencies in the aftermarket too. With qualified 3D printing contractors located worldwide, replaceable parts can be more quickly produced and distributed to aircraft operators and their maintenance organizations in their own regions.

Over the past five or six years, Stratasys has seen a shift in its aerospace business from selling 3D printing machines and materials to lower-tier service bureaus to aerospace OEMs on the top of the supply chain wanting to use the techniques for themselves. “More and more of the aerospace companies are getting smarter in their understanding of the properties of the materials and now we’re doing most of our business with aerospace companies,” he concluded. “It’s almost a requirement for the industry now.”