Click Here to View This Page on Production Frontend

Click Here to Export Node Content

Click Here to View Printer-Friendly Version (Raw Backend)

Note: front-end display has links to styled print versions.

Content Node ID: 405775

Boeing (Stand 1200) is maintaining a bullish long-term outlook for commercial aviation in the Middle East, projecting that the region’s passenger traffic and in-service fleet will more than double by 2040. Middle Eastern carriers will increase their fleets at a higher than global average annual growth rate and continue to outpace their counterparts in North America and Europe in terms of relative annual passenger traffic growth, according to Boeing’s latest Commercial Market Outlook (CMO).

The U.S. airframer’s 2021 CMO, released ahead of the Dubai Airshow, forecasts that the commercial aircraft fleet in the Middle East will grow on average by 4.1 percent per year by 2040 from the pre-Covid base year 2019. That compares to a global annual rate of 3.1 percent. Operators in China, Southeast Asia, and South Asia will likely record a higher annual growth rate of the in-service fleets—of 4.4 percent, 5 percent, and 6.6 percent, respectively—but airlines in North America and Europe will trail Middle Eastern carriers, with a projected annual growth rate of 1.7 percent and 2.7 percent, respectively. In absolute terms, the Middle East-based fleet will expand from 1,510 aircraft in 2019 to 3,530 units in 2040.

The Boeing CMO considers jets of all sizes for passenger and freighter use; it excludes turboprops.

The company expects Middle East passenger traffic, measured in revenue passenger kilometers (RPK), to grow 4.1 percent annually over the 21-year forecast period, more or less in line with the global average of 4 percent. Airlines in North America and Europe, however, will see RPKs grow at a much lower annual rate of 2.7 percent and 3.1 percent, respectively, according to the forecast. Boeing expects the region’s share in global RPKs to increase, from a 12 percent share in 2019 to 13 percent in 2040.

Boeing’s projected robust long-term growth for the Middle East comes despite the slow pace of recovery toward pre-Covid passenger traffic levels in the region. Without large domestic markets, the region’s major carriers rely significantly on connecting, international traffic, which remains subject to travel restrictions.

“The long-term underlying demand drivers remain intact, globally and in the Middle East,” explained Randy Heisey, Boeing's managing director of commercial marketing for the Middle East and Africa. The Middle East’s geographic location provides for a unique “from-anywhere-to-anywhere” business model, he said, noting that an eight-hour flight from the region’s hubs can reach 80 percent of the world’s population and 70 percent of global economic growth for the next two decades. “Growth will be enhanced by diversification of economies as there is increased focus on building tourism and infrastructure,” he added, citing Saudi Arabia’s Vision 2030 economic reform program as an example. Saudi Arabia is the largest country in the Middle East and its Vision 2030 program, introduced in 2016, aims to reduce the country’s dependence on oil and develop Saudi Arabia into an investment powerhouse and the preferred hub connecting three continents.

“Demand is not the problem, travel restrictions are the problem and the confusion about the restrictions,” asserted Heisey, expressing a view shared by the International Air Transport Association (IATA). Asia-Pacific, which represents a major market for Middle Eastern carriers, continues to suffer “some of the most draconian travel restrictions,” IATA senior economist Ezgi Gulbas noted when presenting the trade body’s latest outlook for the airline industry’s financial performance at the IATA AGM in Boston in October. IATA does not expect “significant” improvements in the Asia-Pacific international market until later in 2022, he said. RPKs on routes between the Middle East and Asia are expected to be just 25 percent of pre-Covid levels this year and 41 percent in 2022.

Covid-19 Bites into Long-term Outlook

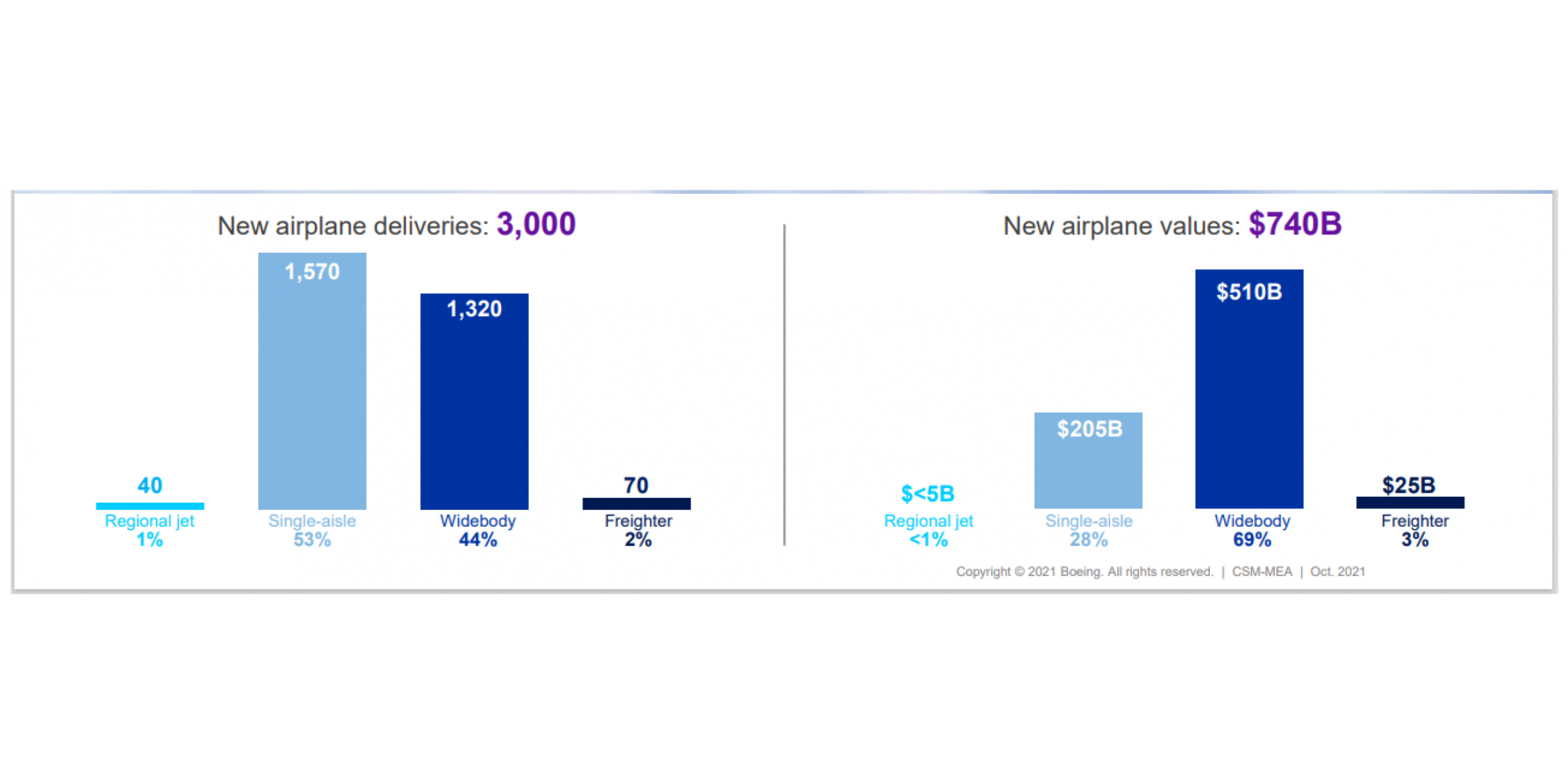

Boeing’s 2021 CMO charts an above-average growth rate for Middle Eastern carriers in the next two decades, but comparison with the 2019 outlook reveals the sizeable impact of the pandemic. Pre-Covid, the U.S. aircraft manufacturer predicted airlines in the region would grow their in-service fleets at a 4.9 percent annual rate and RPKs to expand 5.1 percent per year. It has also revised projected new deliveries downwards. In 2019, Boeing said that airlines in the Middle East would require 3,130 new airplanes valued at $725 billion over the 20-year forecast period and expand their fleets to 4,030 jet airplanes in 2038. It now forecasts a demand for 3,000 new deliveries valued at $700 billion and the number of passenger and cargo airliners operating in the Middle East to total 3,530 in 2040.

With 3,000 new deliveries, the Middle East accounts for just under 7 percent of the projected global demand for new jets across all segments through 2040.

More than two-thirds of airplane deliveries (2,020 units) to the Middle East throughout the forecast period will accommodate growth, while one-third of deliveries (980 aircraft) fulfill replacement demand. Replacing older airplanes with more fuel-efficient models provides significant cost savings and environmental benefits, amounting to $3.5 billion fuel costs savings per year, $6 billion operating savings per year, and an annual reduction of 14 million tonnes of CO2 per year, observed Heisey. Like in other regions, Covid-19 caused an “early retirement shock” in the Middle East, though that replacement dynamic—which also marked past major disruptions such as 9/11 and the financial crisis—will work through the system and the retirement/replacement cycle will gradually return to the “normal” balance.

Rising Single-aisle Demand

The CMO projects the region will continue to see “robust” widebody demand, resulting in 1,320 deliveries to support a growing network of international routes and sixth-freedom passenger and cargo flow over key hubs like Dubai and Doha. Twin-aisle jets will account for 44 percent of all deliveries by 2040, the highest proportion of any other region, Heisey said. However, Middle Eastern airlines have begun to boost their single-aisle fleets to serve growing regional traffic, feed hubs from secondary destinations, or support LCCs. “We frequently talk about the Middle East as being a widebody market, but 44 percent of the [present] fleet is single-aisle and 53 percent of projected deliveries are within the single-aisle segment,” Heisey pointed out. The forecast projects the current single-aisle fleet of 660 airplanes will nearly triple to 1,750 jets in 2040, accounting for nearly half of the total Middle East fleet.

In the cargo segment, Boeing identifies a need for 70 new freighter deliveries through the forecast period and it projects that the freighter fleet will nearly double from 80 airplanes in 2019 to 150 by 2040. Air cargo traffic flown by Middle East carriers has increased by nearly 20 percent in the 12 months to July, according to Heisey. “It is noteworthy that two cargo carriers in the Middle East rank in the global top five,” he said. Qatar Airways became world’s third-largest carrier by freight tonne kilometers (FTK) in 2020—after U.S. integrators FedEx and UPS—up from a 19th position in 2010. Emirates ranked fourth in terms of FTKs last year.

On a global level, the Boeing CMO projects the world’s freighter fleet will expand from 2,010 units in 2019 to 3,435 units, for an increase of 70 percent over the pre-pandemic fleet. The freighter fleet grew by nearly 100 units last year due to Covid-19, according to data compiled by Boeing.