Click Here to View This Page on Production Frontend

Click Here to Export Node Content

Click Here to View Printer-Friendly Version (Raw Backend)

Note: front-end display has links to styled print versions.

Content Node ID: 400393

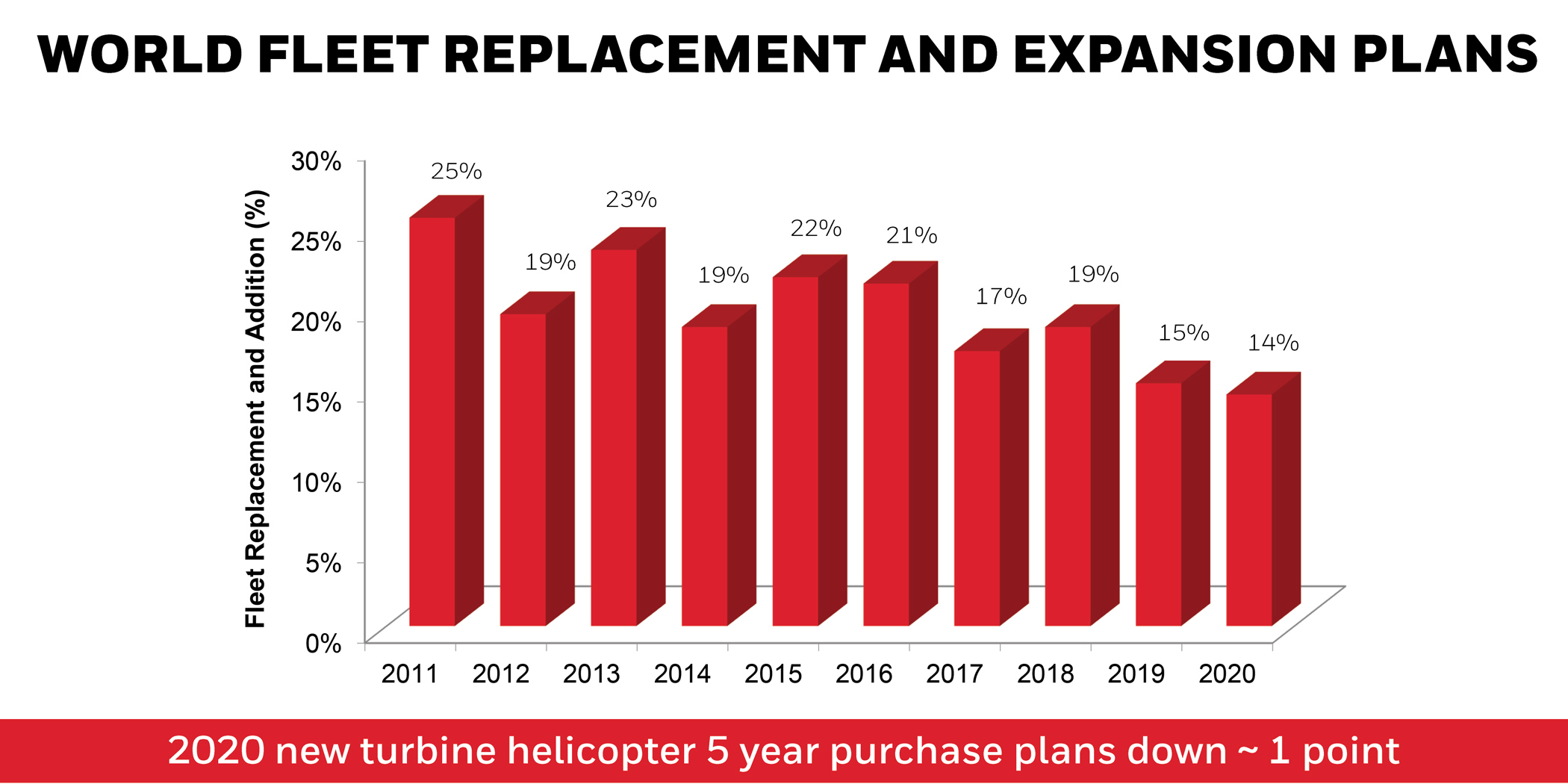

Total helicopter deliveries will increase slightly to 4,100 units between 2020 and 2024 while overall purchase plans slip slightly in the same period, according to Honeywell’s 22nd annual Turbine-Powered Civil Helicopter Purchase Outlook., This year’s forecast expects about 100 more helicopter deliveries over the five-year period compared with the 2019 forecast. While purchase plans are lower than last year’s forecast, Honeywell executives note they’re only down by less than a percentage point.

“This year, we anticipate higher deliveries due to entry into service of new helicopter platforms,” said Honeywell Americas Aftermarket president Heath Patrick. “Despite the slight dip in purchase plans, we see several bright spots, including higher utilization rates. This means operators plan to use their aircraft more frequently over the next 12 months.”

The three top factors operators consider when making a new helicopter purchase are brand experience, aircraft performance, and cabin size, according to the forecast.

Between mid-October and mid-December, Honeywell surveyed more than 1,000 chief pilots and flight department managers of companies operating 3,559 turbine and 282 piston helicopters worldwide for the forecast.

Higher utilization expectations by survey respondents stood out in particular in North America and Europe. In North America, it increased by about 12 percent from the 2019 forecast, with about 19 percent of respondents expecting fleet utilization to rise in the next 12 months. And in Europe, utilization expectations were up 6 percent in 2019 compared with 2018, and 13 percent of respondents said 2020 will be higher than in 2019.

Higher deliveries over the next five years will be supported by new models, including the Airbus H160, Bell 525 Relentless, Kopter SH09, and Leonardo AW109 Trekker, Honeywell Aerospace senior manager of market research Gaetan Handfield told AIN. “Longer term, the outlook will be supported by the expectation of more favorable exchange rates,” he added.

“As you know this market is less U.S.-centric than the business aviation market, about 55 to 60 percent of deliveries are international, so [the rotorcraft market is] very dependent on exchange rates and commodities, which are predicted to be better moving forward than the last couple of years.” The forecast’s delivery growth breaks down to an annual rate of 2.7 percent, which is in line with the world’s economic growth rate over the next five years, Handfield said.

Regional Variation

While overall purchase plans are down 0.8 percent compared with last year’s forecast, they vary—some substantially—by region. Europe, Latin America, and BRIC (Brazil, Russia, India, and China) are the only examples of the forecast’s six regions where purchase plans increased. More than 18 percent of survey respondents in Europe expected to replace or expand their fleets with new helicopters in the next five years, compared with 15 percent of survey respondents last year.

In Latin America, new helicopter purchase plans increased by 20 percent from last year’s survey—well above the global average of 14 percent. “Last year [Latin America’s purchase plan rate] was quite down at 9 percent,” Handfield said. “Historically, Latin America was above 20 [percent].”

The reasons for that lower rate last year varied by countries in the region, he explained: Mexico was affected by uncertainty around a trade deal with the U.S.; there was a political crisis in Venezuela; and a new, right-wing government was being installed in Brazil, leading to uncertainty there as well. “Each one of these also is very dependent on oil prices, so again, this was all playing into the results,” Handfield said.

With a trade deal in place between Mexico and the U.S., a not “as dominant” political crisis in Venezuela, and better certainty around with Brazil’s new government, overall confidence has returned to the region. “There was a big jump in Brazil in the corporate sector," he said, adding that in last year’s survey Brazil only had six mentions for new helicopters while the new survey has 40 mentions there. “A lot of that has to deal with the corporate sector that totally disappeared last year,” Handfield said. “So every region, every country has its own stories and that changes over time.”

New helicopter purchase plans were also higher—4 percent—for the BRIC region, but it is all driven by Brazil, Handfield noted. “China, India, and Russia are actually lower in 2019 when compared to 2018,” he said.

Also, lower were the regions of North America, Asia-Pacific and the Middle East and Africa, the latter of which saw purchase plans fall the most—10 percent—compared with last year’s survey.

Purchase plans were down 6 percent in North America, which accounts for about a third of the global helicopter fleet. Twelve percent of North American survey respondents this year planned to replace their fleets compared with 18 percent in last year’s survey.

“That’s a bit of a surprise if you ask me,” Handfield said, noting that the stock market performed well in 2019 and the economy was robust. Part of that decline is related specifically to the law enforcement sector, which last year accounted for more than 100 mentions of new helicopter purchases/replacements.

He noted that the high number for law enforcement in the 2019 forecast was an anomaly, whereas this year’s number of 50 mentions for new helicopters is a historically normal figure. Purchase plans also were 6 percent lower year-over-year among Asia-Pacific respondents.

Most of the overall purchases are expected to occur this year—more than 20 percent—and 2024—nearly 45 percent—according to the forecast.

Among industry sectors, new-helicopter purchase plans were significantly stronger in the corporate/VIP and emergency medical services/search-and-rescue segments, while it was weaker in the law enforcement and oil-and-gas segments. Oil-and-gas and the heavy and intermediate helicopters this industry flies continue to be a challenging market, especially with oil only around $60 a barrel. “There’s still a very high inventory out there,” Handfield said. “I don’t see any improvement yet.”

Type Preference

Regional variation continues with favored helicopter types. While light single-engine helicopters continue to be the survey’s overall most favored type—because of price, range of utility, and direct operating costs—preferences change based on region.

According to this year’s survey, intermediate and medium twin-engine classes accounted for 41 percent of total purchase plans for new helicopters in Europe. Meanwhile, 37 percent of respondents indicated plans to purchase light single-engine helicopters, up 5 percentage points from last year.

In the Middle East and Africa region, nearly 62 percent of new-helicopter purchases will be light twin-engine models. In Asia-Pacific, 38 percent of purchases are expected to be intermediate/medium twin engines and 32 percent are planned for light singles. And in Latin America and North America, light singles account for more than half of new helicopter purchase plans.