Click Here to View This Page on Production Frontend

Click Here to Export Node Content

Click Here to View Printer-Friendly Version (Raw Backend)

Note: front-end display has links to styled print versions.

Content Node ID: 401057

By mid-March, while much of the rest of the world was locking down to combat Covid-19, the Asia-Pacific (APAC) region was “beginning to see the light at the end of the tunnel,” said Asian Business Aviation Association (AsBAA) chairman and CEO Wu Zhendong. This despite restricted flight operations and unknown industry effects going forward. Yet any region anchored by a 4,000-year-old civilization takes a long-term view, and with the epidemic receding—having claimed this year’s ABACE trade show in Shanghai among its victims—its business aviation community is looking ahead.

Jason Liao, chairman and CEO of consultancy China Business Aviation Group in Beijing, expects the crisis to have “very negative” effects on the industry now, “but the long-term prospect is very positive: general aviation is playing a very active role in the war against coronavirus by providing transportation of critical supplies and key personnel—the first time in Chinese history it has played such a critical role,” he said. “The government, the public, the media, and potential customers have realized the benefits of business aircraft.”

TAG Aviation Asia CEO Jolie Howard agreed. “The number of humanitarian flights showed we can help in many ways beyond just transporting VIPs.” She also noted that many Chinese students studying aboard, stranded by airline groundings, were repatriated by charter flights. “It has added good, positive visibility for our industry,” said Howard.

The 2002-03 SARS epidemic gave many regional providers experience that helped them operate during this current outbreak.

“I would say it caused this part of the world to react more quickly,” said Louis Smyth, a senior manager at Universal Weather and Aviation in Hong Kong. “We have a stock of masks and hand sanitizers, and we were able to quickly activate our emergency response and business continuity plans for each office.”

“We were actually doing very well in 2019—it was a record year for traffic,” Smyth added. “Obviously with Covid, the future is a guessing game.”

Regional Review

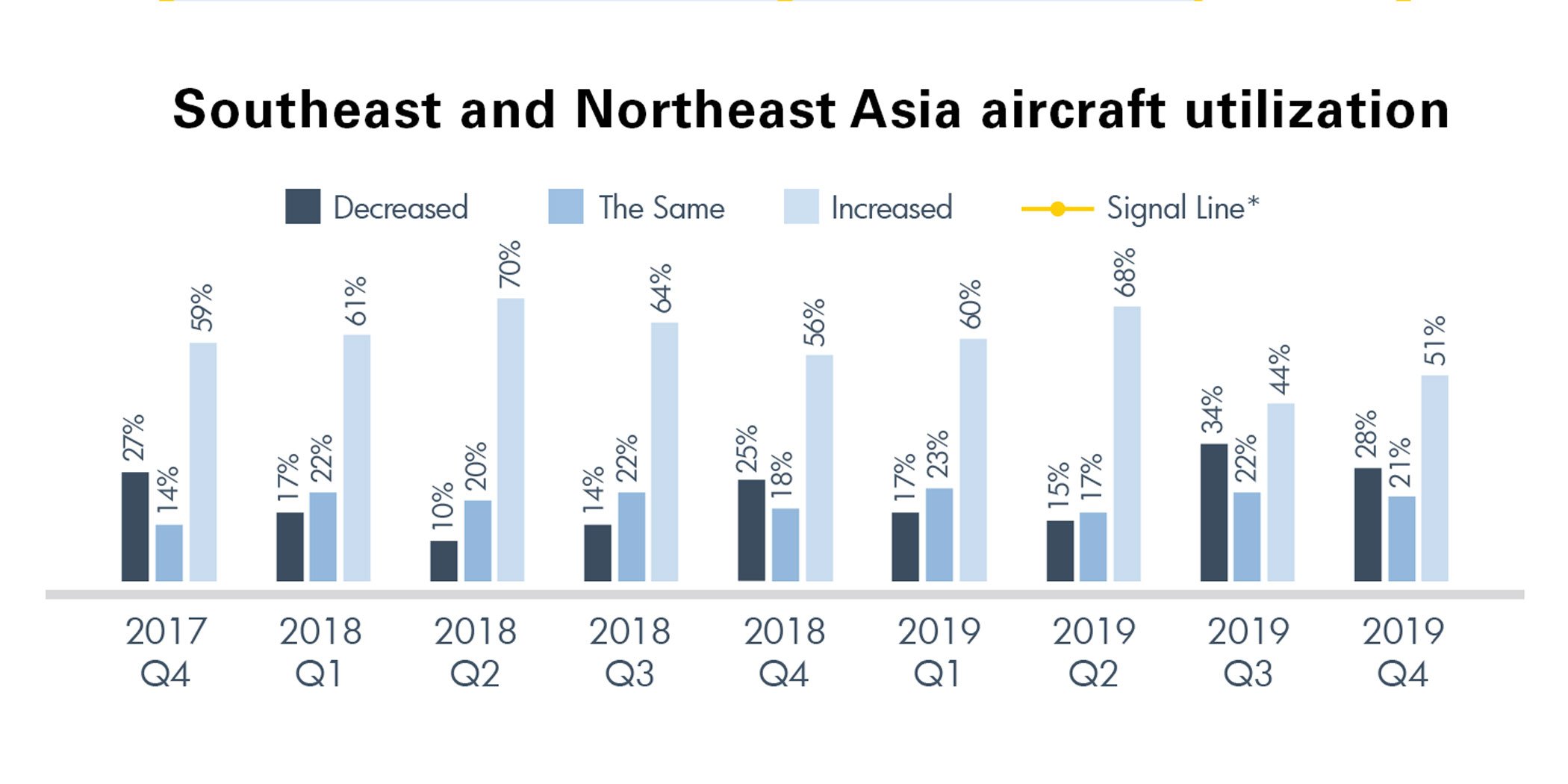

Southeast Asia is now the region’s presumptive growth driver, according to Asian Sky Group (ASG). Japan, Singapore, Thailand, and Vietnam all saw increased activity last year, with more than half (51 percent) of respondents in Southeast and Northeast Asia reporting increased flying in last year’s final quarter. Mainland China, meanwhile, registered an “unquestionably quite gloomy” 2019, said Jeffrey Lowe, managing director of Hong Kong-based consultancy ASG. Business aviation operations fell 18 percent year-over-year in Greater China, the region’s largest decline, and the People’s Republic’s GDP growth in Q3 was the weakest in more than a quarter century.

AsBAA’s Zhendong sees some positives in China’s slowdown. “Five or six years ago, the government was encouraging people to get into general aviation, but people found out it’s not that easy to make money. Now, the industry has come down to reality,” he said. “It’s more professional, and that’s a healthy thing.”

Meanwhile, the Philippines, Indonesia, and other “smaller regions,” report increased activity, he said.

AsBAA’s current policy issues include ongoing advocacy for greater availability of landing and parking slots for business aircraft at congested airports, and more immediately, against the reduced operating hours at Seletar Airport, Singapore’s general aviation [GA] facility. In tandem, AsBAA is focused on increasing membership to give the industry a louder voice, by opening membership to helicopter and light aircraft manufacturers and the other 80 percent of the GA industry that “is not in business jets,” Zhendong said, which includes more than 1,000 companies. Newly hired AsBAA COO Jeff Chiang heads this effort to grow the current membership of about 150.

In the absence this year of ABACE, its prime communication and meeting platform, AsBAA is teaming with ASG to host an online “Fleet Week” gathering on the web (April 21-23), anchored by the release of the consultancy’s annual Asia-Pacific Business Jet Fleet Report. Cataloging the region’s gains and losses of business aircraft, tracked by country, manufacturer, cabin size, and other categories, the report, traditionally released at ABACE, is a valued barometer of APAC’s fortunes.

Other AsBAA initiatives—its annual Safety Day programs staged in Hong Kong, Mainland China, Philippines, Singapore, and Malaysia; the in-school Discovery Program that educates students of all ages in the region about business aviation and career opportunities; and gender equality programs—remain on track.

The OEMs

Sales activity for new business aircraft in the region has ground to a halt, according to manufacturers, as their salespeople have ceased travel and prospects are reluctant to hold face-to-face meetings. Meanwhile, the cancellation of ABACE eliminates a platform where prospective customers could see aircraft side-by-side. OEMs are adjusting marketing plans and recalibrating sales projections while continuing to expand their less glamorous, but essential regional aftermarket support services.

Falcon Jet manufacturer Dassault Aviation was changing its regional marketing focus from the flagship Falcon 8X to the forthcoming Falcon 6X, slated to enter service in 2022 when Covid-19 emerged. Dassault displayed at the Singapore Air Show a cabin mockup of the 6X, touted as the widest and tallest cabin in a purpose-built business jet. “We got a lot of positive reaction,” said Jean-Michel Jacob, senior v-p, Falcon Sales for APAC. “People were amazed by the size.”

Australia, New Zealand, and other Southeast Asia markets are promising, but China sales already faced headwinds due to its economy and impact of the trade war with the U.S.

Dassault’s production is unaffected by Covid-19-related supply chain issues, said Carlos Brana, executive vice president of civil aircraft for Dassault Aviation. “We have constant communication with suppliers, and we’re watching very carefully.”

Meanwhile, Dassault has bolstered its already substantial regional aftermarket-services presence with the acquisition of ExecuJet’s MRO business, which includes ExecuJet Malaysia at Subang Airport and four Australian locations and one New Zealand facility.

“It’s absolutely clear that our customers appreciate our incredible investment [in regional support], and this will help us a lot in the future,” Brana said. Additionally, Hawker Pacific MROs are factory authorized service centers, and support teams are based in locations including Beijing, Hong Kong, Singapore, Korea, Australia, and Taiwan.

Honda Aircraft Company has “rapidly expanded our footprint in Asia” over the past two years, said Michimasa Fujino, president and CEO of the HondaJet manufacturer. In this region, Honda is targeting “individuals who may have never considered the benefits of business aviation before,” Fujino said, noting that 25 percent of its customers are first-time buyers.

Last year the light jet earned its type certification approvals from China and Japan, and deliveries have commenced. Five HondaJets went to Japan last year, with more than 10 more on order. Further deliveries to China await resolution of the Covid-19 crisis.

HondaJet China expects to receive China CCAR 135 certification for HondaJet charter operations for its FlightJoy aircraft charter and management venture, and approval for charter in Japan is also expected.

The upgraded HondaJet Elite, which entered service last August, made its regional debut at the Singapore Airshow in February, receiving “a very positive response,” Fujino said, forecasting “significant growth in the China-APAC region going forward.”

With its global market expanding, Honda plans to increase its four-per-month production rate following completion of a new wing production and parts storage facility this year, and is exploring “highly-automated technology to support our production.”

Featuring Honda’s patented over-the-wing engine mount, the Elite version offers enhanced range, useful load and performance; improved avionics and automation in the cockpit; optional Bongiovi speakerless sound system in the cabin; and a belted lavatory in the back. A medevac interior is also available.

Bombardier sees “real growth opportunities in China and Asia-Pacific,” with strong interest in both its new Global 7500 and recently introduced Global 5500/6500 aircraft in the region, the company said. With the sale of its rail transportation division, announced in February, the Canadian manufacturer of Global, Challenger, and Learjet business jets will “focus all our capital, energy, and resources on accelerating growth and driving margin expansion in our market-leading $7.0 billion business aircraft franchise,” said Alain Bellemare, current president and CEO, soon to be replaced in that role by former business aviation division leader Eric Martel.

In late 2019, Bombardier delivered the first of four Global 6500s ordered by Hong Kong’s HK Bellawings, which has also firmed up its order for four Global 7500s, with options for additional aircraft.

To support Globals, Challengers, and Learjets in the region, Bombardier is expanding its Singapore Service Centre at Seletar Airport and will more than quadruple the facility’s footprint. The upgraded center will offer full interior finishing capabilities, enhanced maintenance and modification capabilities, a paint facility, parts depot, and flight- and ground-handling services.

Additionally, TAG Aviation’s Hong Kong facility is now a Bombardier authorized service facility, offering line maintenance services for some Challenger and Global models, including the Global 7500.

At the light end of its fleet, the Canadian airframer sees “real potential growth for the Learjet 75 Liberty in China and Asia-Pacific.” Launched last summer, the updated platform features a lower price ($9.9 million) and a more comfortable cabin than its predecessor.

Gulfstream Aerospace planned to showcase at ABACE a scaled interactive cutaway model of its forthcoming flagship, the G700, unveiled at NBAA-BACE in October. With the cancellation of ABACE, the U.S. airframer is highlighting its customer support network for the 345 Gulfstreams in the region’s fleet, said a company spokeswoman.

The company-owned Gulfstream Beijing service center at Beijing Capital International Airport offers service for Gulfstreams registered in China, the U.S., Hong Kong, Macao, the Cayman Islands, Isle of Man, and Guernsey and is complemented by Jet Aviation’s Gulfstream-authorized maintenance facilities in Hong Kong and Singapore.

At Gulfstream’s Asia Customer Support Contact Center near Hong Kong International Airport, the staff includes a computer maintenance program analyst, over-the-counter parts sales and warranty specialist, and a regional customer support manager. Beefing up its regional support, last year, Ernest Tai joined the Asia-Pacific team as managing director for customer support.

With sister company Jet Aviation’s acquisition of Hawker Pacific, the latter’s MRO station at Shanghai’s Hongqiao International Airport is now a Gulfstream authorized warranty facility. The location, which hosts ABACE, last year received approvals from the CAAC and the Bailiwick of Guernsey to perform maintenance on the G650, said Louis Leong, v-p Asia and general manager for Gulfstream sister company Jet Aviation’s Singapore location.

Textron Aviation, manufacturer of Cessna, Beechcraft, and (out-of-production) Hawker business aircraft, continues to see “strong customer interest” in the APAC region. Mike Shih, Textron v-p of strategy and business development for China, singled out the Cessna Grand Caravan EX single-engine turboprop and Beechcraft King Air 350i twin-turboprop as popular models, finding favor “in special-mission operations, such as medical transport.”

To support the fleet, Textron recently added three more company-owned service centers with the January acquisition of Australian MRO Premiair Aviation, previously a Textron authorized service facility, which adds a trio of facilities on the island continent, where the airframer recently established a parts warehouse. Textron also recently opened a new service location in Manila in collaboration with PhilJets Aero Services and expanded its Singapore parts warehouse.

Meanwhile, whatever the current market in China, Textron Aviation and its sister company helicopter manufacturer Bell “continue to see firm support from the Chinese government in support of general aviation,” said Shih.

U.S.-based and Brunei-owned Piper Aircraft, manufacturer of aircraft spanning the general aviation and business aviation markets, recently introduced a new version of its flagship M600 single-engine turboprop and two new “value-priced” piston trainers.

The M600/SLS (Safety, Luxury, and Support) includes its Piper’s Halo system, featuring Garmin’s Autoland as standard equipment. Autoland takes control of the aircraft in the event of pilot incapacitation, selects an appropriate airport, and then flies, lands, and stops the aircraft on the runway, all while autonomously communicating with air traffic control facilities and passengers.

At the other end of its fleet, Piper has introduced the Piper Pilot 100 and Pilot 100i trainers, available in limited quantities beginning this year. The Pilot 100 features a 180-hp Continental Prime IO-370-D3A engine and Garmin G3X Touch avionics. The Pilot 100i offers an IFR-capable upgrade package.

Management and Charter

“To sum up, there’s quite a bit of uncertainty,” said Howard at TAG Aviation Asia, which has some 46 aircraft under management in locations including Mainland China, Hong Kong, Thailand, Malaysia, and Indonesia and offers charter, management, MRO, and transaction services. The virus came to wide attention in late January when many clients were on vacation for Chinese New Year.

“Quite a number of clients overseas decided to extend their stays, to see how things go,” Howard said. Since then, flight restrictions have expanded in lockstep with the epidemic. “I don’t think we’re seeing the full impact yet,” he added. “We’ve never seen these types of travel restrictions.”

Among many unforeseen impacts: temporarily out-of-work airliners are taking up swaths of parking at prime airports, squeezing out business aircraft.

Meanwhile TAG continues a “transformation” that began three years ago, expanding from management-only to become a full-service provider, a change made possible by owners’ willingness to make their aircraft available for charter.

“As the market matures, people realize the cost benefits” of generating charter revenues to offset operating expenses, said Howard.

Additionally, TAG’s MRO services support its own fleet while also drawing other operators’ customers for maintenance. And its on-airport operations—TAG opened a full-service FBO in Macao last year—serve as another customer portal.

Malaysia is among the region’s burgeoning business aviation markets. Asia Jet Partners Malaysia (AJPM), the country’s sole commercially registered private jet operator, is “growing our charter and managed fleet and bolstering our maintenance capability,” said company CEO Stutijn van Till. AJPM is adding this spring a second Bombardier Global 5000 to its fleet, based at Subang Sultan Abdul Aziz Shan Airport in Kuala Lumpur, and plans to move into a new hangar facility as part of the airport’s redevelopment masterplan.

Five-year-old AJPM has a 9M commercial air operator certificate from the Civil Aviation Authority of Malaysia and an air services permit from the Malaysian Aviation Commission.

“We are looking to establish a suite of business aviation services in Malaysia that will rival the excellent facilities at Seletar in Singapore,” said van Till. “Mature Southeast Asia business hubs such as Hong Kong and Singapore are becoming congested and expensive. Our goal is to deliver a first-class experience for private jet companies coming into Subang, supported by modern facilities and excellent infrastructure.”

Charter operator VistaJet is “cautiously optimistic” for 2020, “despite the unique challenges” Covid-19 presents, the company said. In March, the flagship service of parent company Dubai-based Vista Global Holding (VGH) reported a 16 percent increase in flights through the first 10 weeks of the year, a jump that “includes fliers looking for safer and cleaner alternatives to commercial flying,” said VGH chairman and VistaJet founder Thomas Flohr.

This follows “a record” 2019, according to Vista. Globally, memberships rose 26 percent, flights increased 24 percent, and passenger count grew 35 percent. Memberships in Asia, which represent 11 percent of global demand, grew by 6 percent, with China, India, and Singapore leading the charge.

VistaJet operates only late-model, large-cabin Bombardiers, including the Global 7500, which joined the fleet this year.

Singapore-based charter broker Apertus Aviation specializes in smaller-cabin jets for charter flights within the APAC region and for Asian clients traveling within the U.S. and Europe.

Overcoming “cultural resistance to smaller planes is a constant battle,” said managing director Ringo Fan. “But China is a fast learner; people adapt quickly. In business aviation as well, the next generation is realizing a large cabin isn’t necessary with only two passengers.”

The company has staff in Hong Kong, Beijing, and as of last year, London, in addition to its Singapore headquarters.

In addition to a network of vetted operators, Apertus is the exclusive charter agent for a G200 based in China, one of the smallest business jets available for charter in the People’s Republic, according to Fan. Though demand in China “is dynamic, going up and down, one day to the next,” he said, the 10-year-old brokerage has never felt the impact of austerity or anti-corruption campaigns.

“We’ve always focused on the less wealthy part—they’re not multi-millionaires,” said Fan of his customers. “That’s a pocket of the population the government relies on to grow the economy steadily. These clients aren’t flashing [expensive] watches around, they don’t need the ramp presence of a G650.”

Fan, whose parents are Chinese, was born and grew up in Australia and wants to fuse the best of those cultural differences in delivering the company’s services. Its sister enterprise, 1903 Aviation (named for the year of the Wright Brothers’ first powered-aircraft flight), is a membership program for international lift offered in collaboration with German operator Air Hamburg, providing customized block hour charter programs. Referrals from 1903 customers, whose associates sought ad hoc charter, led to Apertus’s foundation.

Flight Support Services

Coming out of 2019, flight handler Universal Weather and Aviation ranked Japan and Thailand as top blossoming regional markets, said Smyth. China dropped off the list last year, but Beijing, where Universal provides handling services for international flights (sans facilities) continues to register heavy traffic, said Cynthia Zhang, UA China Managing Director. Where it would usually handle about 30 flights in February, after the cancellations this year, it handled five.

Meanwhile, with more business aviation users employing flight-planning and filing software for their flight handling, Universal has been de-emphasizing its in-house handling and support services in favor of developing and providing online tools and apps of its own, like its uvGO mobile flight-planning app. That shift was underscored by the recent sale of its UVair fuel subsidiary to World Fuel (now Universal’s exclusive fuel provider).

“Fuel is a commodity, and margins are going to be lower and lower,” said Smyth. “But traffic is increasing, so one of the best focus areas is technology. We want to hit the perfect full-service balance between high-touch and high-tech.

Jetex reported increased demand for charter and ground handling services in the APAC region, with charter flights up more than 20 percent in February, year-over-year, and expects the region’s appetite for these services “will remain resilient.” Bolstering that belief, Jetex points to recent research from the World Travel & Tourism Council. Examining previous economic calamities that impacted travel, the council reported that between 2001 and 2018, the post-crisis recovery time decreased from 26 months to 10 months, on average.

Preowned market effect

As with new aircraft, preowned sales in the region have come to a standstill, and the long-term impact of the crisis on inventory and pricing is unknown, but there are no signs of panic in the market. “We’re not seeing a surge of aircraft for sale,” said TAG’s Howard, adding, “more uncertainty is going to play out.”

David Dixon, president of aircraft transactions specialist Jetcraft Asia, believes this crisis will have more far-reaching effects on business as a whole than did SARS, due to the stronger connections between China and the rest of the world economy today. But it could have the opposite impact on preowned transactions. “If SARS is a pointer to the impact on business aircraft sales, there were, in my experience, some buyers who were unconvinced that they needed or wanted a private aircraft until the health threat changed everything,” Dixon said. “I sold a few arising from this problem. In that sense, it might not be all bad.”

Going Forward

No doubt China remains the region’s 800-pound sleeping gorilla at the moment, but no one sees the People’s Republic as backing down on its private aviation bet.

“At the highest level in China there is still recognition and support and investment in general aviation,” said Doug Carr, v-p of regulatory and international affairs for ABACE co-sponsor NBAA. “What that looks like on the front lines are more companies, more policies, and procedural changes” to encourage its growth.

The NBAA is already looking ahead to next year’s Shanghai show, where it will “continue focusing on our core messages,” those being increased access to airspace, technology innovation, safety training, and business aviation-friendly policies and procedures.

Carr added that the association had no major announcements or initiatives it planned to introduce at ABACE this year, having released at NBAA-BACE in October its proposals for protecting the privacy and security of business aviation aircraft and flights in the era of ADS-B and other flight-tracking and identification technologies, a current priority.

As for the cancellation of this year’s event, “We always came at it with an eye toward the health, safety, and well-being of all show participants,” said Carr. “We have a standard, and when we looked at the situation in late January and early February, we made the decision [to cancel] with transparency.”

Among the good news for those who are or will be flying privately to China, operators are seeing “night-and-day improvements in business aviation operations,” said Nat Iyengar, a Hong Kong-based captain for Jet Aviation. He cited improvements in ATC, handling and ground support services, and better access to airports and airspace.

“Operating is 100 times easier now than a decade ago, and I’d say almost 100 times easier than five years ago,” Iyengar said. China’s ATC is “reaching out to foreign ATC units—Eurocontrol, the FAA—and sending their people around the world, making the system more efficient.”

One example: “For the first time in my life, we got cleared for a visual approach [in China]. That was not in the Chinese playbook.”

Though the military controls China’s airspace, pilots are now often receiving permission to remain at requested altitudes far longer before descents and climbs to requested altitudes sooner after takeoffs, he said. “Yes, there are times when you’re flying Beijing to Shanghai and you’ll be kept at 30,000 [feet]; but there are times [flying] Washington, D.C. to Boston you’ll be at 3,500.”

Another change Iyengar has observed: “You see a lot of business jets in China which are true company airplanes; you’re not seeing the high-flying, ostentatious flamboyant spending you did [before]. There’s a very established wealthy, and middle class.”

Summing up what could be advice for all of business aviation in China, Iyengar has one word of advice for passengers and crews: “Patience.” Long delays on departure and for taxiing are common.