Click Here to View This Page on Production Frontend

Click Here to Export Node Content

Click Here to View Printer-Friendly Version (Raw Backend)

Note: front-end display has links to styled print versions.

Content Node ID: 402231

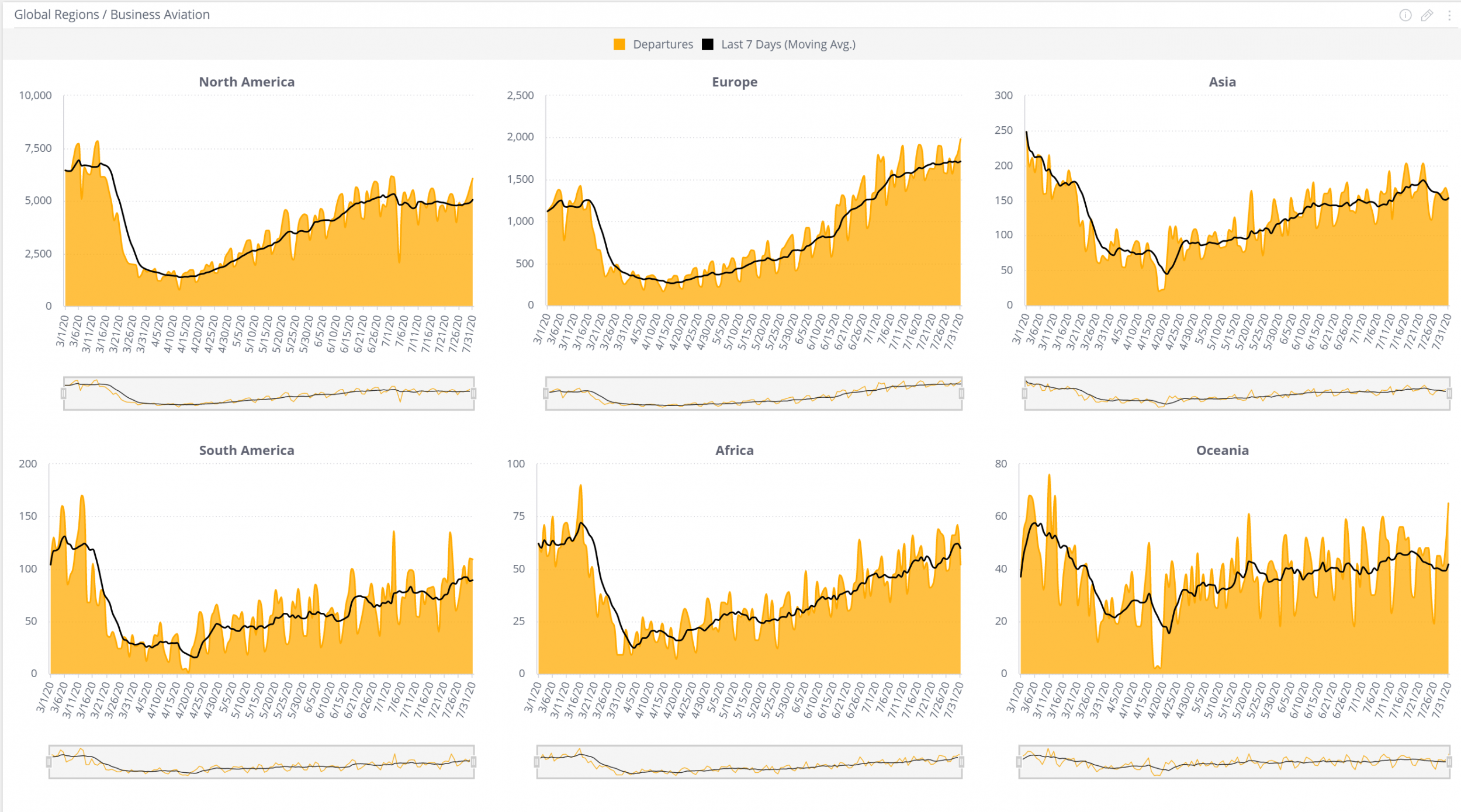

Business aviation flight activity has seen a welcome resurgence in recent weeks, with positive trends being most evident in areas where demand for trips has been bolstered by the Northern Hemisphere summer season, according to the latest Global Market Tracker produced by aviation data specialist WingX. Throughout July and into the first few days of August, activity levels were just 18 percent below where they had been during the same period of 2019, with more than 23,000 business aircraft operating some 500,000 flight hours.

The European market, which historically has always counted on higher demand during the peak summer period, saw activity levels at 89 percent of the same time last year. By the end of July, WingX’s seven-day rolling average recorded more than 2,200 sectors, compared to 1,800 at the start of the month and just 452 during the most severe Covid-19 restrictions in April. Travel associated with events such as the Hungarian and British Grand Prix car races contributed to the stronger demand.

The recovery trend has not been consistent around the world, with U.S. activity levels declining in recent weeks, apparently in response to concerns over rising Covid infection rates in some states. One month ago, flight hours were within 15 percent of 2019 levels, but these have now dipped to more than 20 percent behind pre-Covid rates.

Some states—including New York, New Jersey, and Illinois—are still seeing flight hour totals around 30 percent below 2019 levels, while California and Texas have been 20 percent below par. By contrast, flights in and out of Colorado and Arizona have been at least 5 percent above the same period last year.

Beyond the U.S. and Europe, business aviation traffic trends have been far more variable. According to WingX, the African market “remains in the doldrums,” while Asia has remained at around 20 percent below 2019 levels, Oceania has kept within 5 percent and South America is “keeping its head above water.” Closer analysis of the data from around the world shows traffic down overall across the Middle East, but with the United Arab Emirates recording strong growth. Similarly, Brazil and Colombia have achieved growth that is out of step with decline across the rest of the continent. Activity in and out of China has been around 85 percent of 2019 levels, while Australia and New Zealand recorded flight hour recoveries in recent months only to see this erode in recent weeks.

Back in Europe, flight activity for Germany, Austria, Switzerland, Croatia, and Belgium has trended above levels seen last year. Spain had shown evidence of recovery in early July, only to fall back more recently in the wake of a Covid resurgence. Turkey, Russia, and the Netherlands have all achieved “robust” recovery, while in the UK, Italy, and Greece this trend has been more gradual.

“The mid-summer comeback in business jet activity has been weaker than anticipated due to the stop-start lockdowns in the U.S.,” commented WingX managing director Richard Koe. “In particular, the East Coast is still in a slump and in Florida, the recovery engine so far, [it] is now spluttering.”

WingX says it will watch to see if vacation travel demand in Europe continues to boost the private charter sector, while expectations in the U.S. market during August remain muted. “The missing piece is the corporate market, and we will have to wait until the autumn to see how the business traveler adapts,” Koe concluded.

Generally speaking, lighter aircraft have continued to be less impacted by the Covid-led downturn than larger jets. Heavy and ultra-long-range jets have seen demand at, respectively, 30 and 35 percent below 2019 levels. Meanwhile, very light jet traffic has been at around 95 percent of hours logged in the same period last year.