Click Here to View This Page on Production Frontend

Click Here to Export Node Content

Click Here to View Printer-Friendly Version (Raw Backend)

Note: front-end display has links to styled print versions.

Content Node ID: 407290

Business aviation data and audit provider Argus International (Booth I49) has launched a new FBO auditing service and will reveal the launch customer, identified as “a large FBO chain” this week ast EBACE 2022. It is also reporting upbeat data showing charter demand “remains very strong” across Europe, a trend the firm anticipates will continue through at least August.

In addition to evaluating traditional Argus safety metrics, the FBO auditing program will also focus on service quality, according to Joe Moeggenberg, president and CEO of the U.S. company. The official unveiling at EBACE follows a soft launch of the FBO program last month at the NBAA Schedulers & Dispatchers Conference in Southern California.

Argus is also showcasing at the show its new ClearView application, an easily customizable big data aggregator introduced at NBAA-BACE in October to support charter providers, fractional operators, MROs, FBOs, fuel providers, OEMs, and other aviation service companies. Providing a global operations dashboard and tracking some 130,000 flights daily, ClearView offers real-time visibility into worldwide operations.

Its customizable features enable benchmarking, filtering, dynamic flight mapping, and data-integrity monitoring, said Argus market intelligence v-p Travis Kuhn. “These are features operators and clients have been asking for.”

ClearView also marks the data service’s expansion beyond its longstanding North American focus. “If you want to see Gulfstream operations in Brazil or operations between Australia and Japan, you can,” said Kuhn.

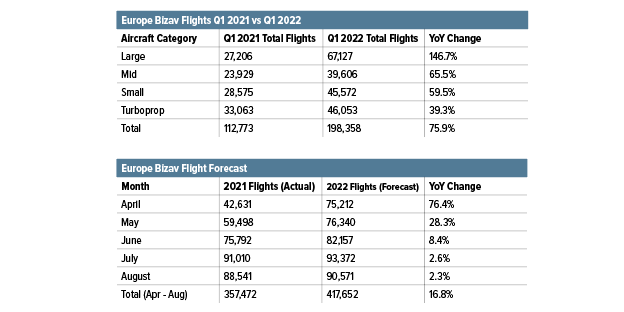

Speaking of its flight operations data, Argus is reporting that European air charter activity in the first quarter was up 75.9 percent year-over-year (YOY), to 198,358 departures. Large-cabin jet flights in the region climbed 146.7 percent YOY in the first quarter, followed by midsize jets with a 65.5 percent increase; light jets, up 59.5 percent; and turboprops, rising 39.3 percent.

Argus predicts charter traffic growth will cool to about a 17 percent YOY jump over the next five months, as anticipated increases are measured against the strong numbers that began to post last May following a “suppressed” start to 2021.

Charter demand in Europe historically fluctuates seasonally—much more so than in the U.S.—from a low beginning in September and running through February to March, before the busy summer season picks up. But in recent years, and particularly since business aviation’s pandemic recovery began last year, “Europe is still following that trend, but the valleys are much smaller than they used to be,” Moeggenberg said. “You're seeing very consistent demand, and that's creating a stronger upside potential.”

These activity levels prevail despite a drop in Eastern Europe charter activity approaching 50 percent, he added. Nonetheless, the war in Ukraine and resultant sanctions on Russia will have large repercussions for charter providers and customers. That includes potentially unprecedented losses at aircraft insurance and leasing companies since “the Russians have absconded with a huge number of aircraft,” Moeggenberg said. That will increase costs for aircraft operators across the board, which will “be passed on to the customer,” he noted.

“Hourly rates will continue to rise and fuel prices will be reflected in fuel surcharges,” Moeggenberg predicted. “I can't tell you at what point customers will say, ‘Enough, I'll take the train.’ There's still a ton of wealth.”

Given that Western-built business jets under Russian control can’t access authorized replacement parts and mandated maintenance, Moeggenberg believes “it’s only a matter of time before [Russian-owned] airplanes will start being grounded.”

Meanwhile, with the exponential growth in tracking metrics and high-speed data networks, Argus is collecting and analyzing more flight and other data on a daily basis, and back-end operations are continually challenged to keep pace. “We are completely rewriting a lot of our processes to keep up with the huge amount of data,” Moeggenberg said, “and to put it into a format that makes sense to the industry.”