Click Here to View This Page on Production Frontend

Click Here to Export Node Content

Click Here to View Printer-Friendly Version (Raw Backend)

Note: front-end display has links to styled print versions.

Content Node ID: 409036

Dramatic changes have occurred in the private jet and turboprop market since the beginning of Covid-19. The market’s first reaction in the spring and summer of 2020 was to freeze. Some buyers walked away from their deposits fearing the economy would collapse. With few transactions, it was difficult to know the true effect of the global pandemic on business aviation.

As the global pandemic took hold over the next several months, aircraft transactions remained slow as travel became difficult due to travel restrictions by state and local governments. Overall, non-essential private jet flights were severely reduced.

After a year and with the introduction of multiple Covid vaccines, private jet travel began to return. Despite the existence of the vaccine, traveling with many other unknown passengers on an airliner was a cause for concern. This concern led many individuals and corporations to turn to private jet travel for essential trips.

Private jet travel was considered a safer alternative because it limited exposure. All private jet operators made the cleaning of the aircraft and consistent testing of the crews a top priority. This gave private jet travel a boost in demand like never before, and, with that, came the demand to purchase private jets and turboprops.

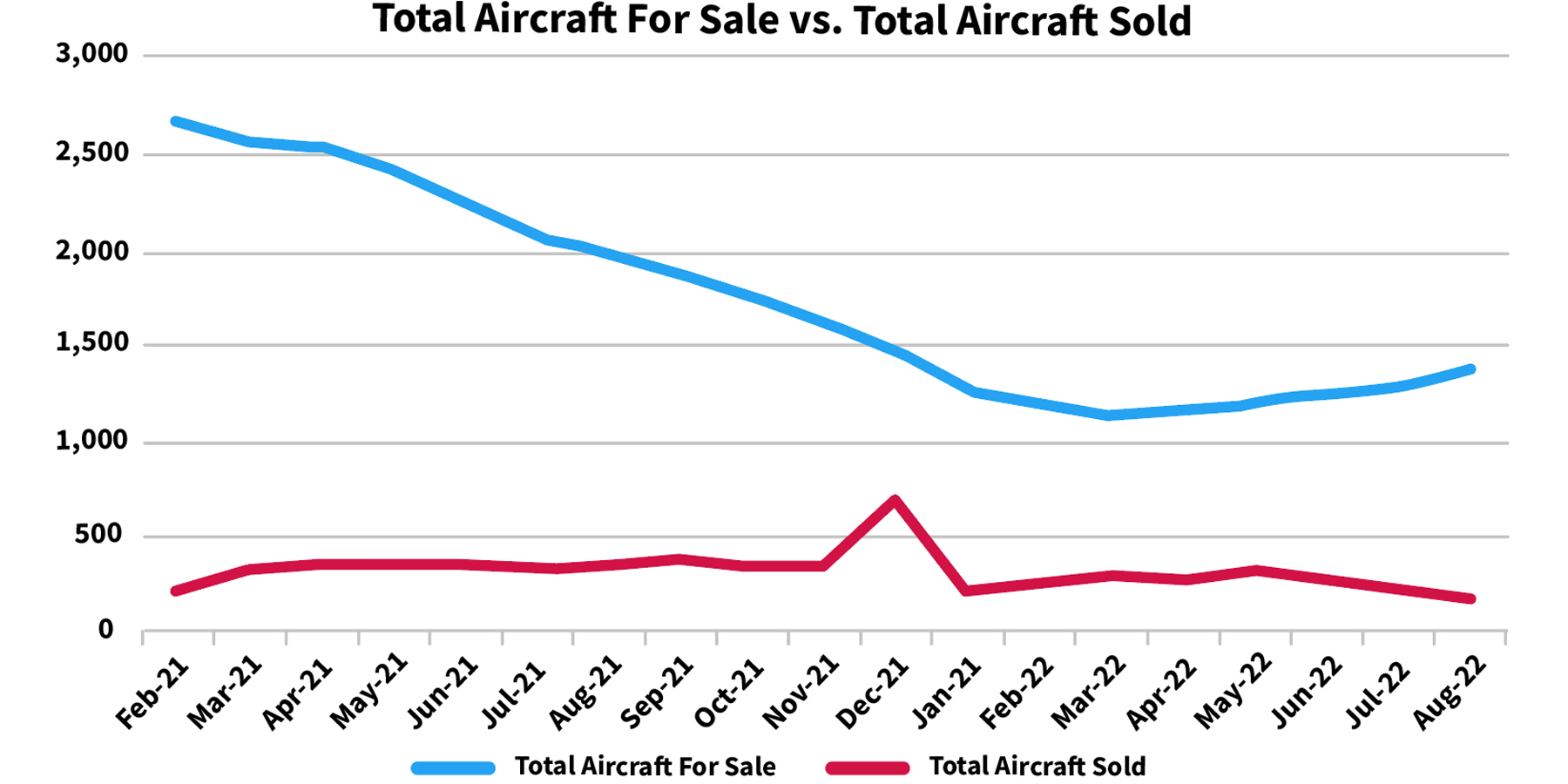

Demand for private jets and turboprops went into overdrive. Over a 13-month period from February 2021 until March 2022, the inventory of private jets and turboprops for sale steadily declined. It is interesting to note that transactions were relatively steady, with the exception of the usual spike at the end of the year. The critical difference was that existing owners of aircraft were not replenishing the aircraft sold with inventory available for sale.

In a normal market, about 10 percent of aircraft in operation around the world are for sale, but by February 2021, that percentage was already reduced to 7.51 percent. By the end of March 2022, the percentage of aircraft in operation had fallen by 60 percent, leading to a low of 3.06 percent of the aircraft in operation that were for sale.

The total number of available aircraft for sale was just over 2,600 in February 2021. By March 2022, that number had fallen to just 1,134. Aircraft sold over that period averaged 353 per month. Since March 2022, the number of aircraft for sale had steadily increased from the low to 1,376 or 4 percent of the aircraft in operation in September.

The market for private jets and turboprops has behaved differently as the reduction in available turboprops was more gradual and lasted until June 2022, when private jet inventory had already begun to climb higher. Another major difference is the spike in transactions in December 2021 was not as dramatic for turboprops.

Effects of the Pandemic Rush on Aircraft Pricing

A fundamental principle of the law of supply and demand is that there is an inverse relationship between pricing and supply when demand remains steady. In the preowned market, supply fell by 60 percent while demand remained steady at more than 350 transactions per month (with an end-of-year rush in December 2021). This inverse relationship shows that as supply decreases, prices increase.

Clearly, aircraft manufacturers and their stakeholders would have enjoyed filling all of the demand for preowned aircraft with as many new aircraft as they could produce. Unfortunately, that is not how it works in aviation. Aircraft are complex machines that require precisely manufactured parts to build. Changing the build rate of an aircraft takes months or even a year or more of forecasting demand, as well as ordering the right amount of the right parts. The global supply change issues that all industries faced were compounded by the inconsistent availability of workers due to Covid or exposure to Covid, and it’s understandable that aircraft manufacturers were not able to increase production to meet the demand. The major benefit the manufacturers received was a very healthy backlog that will likely take them several years to work through.

With steady demand and a steep decline in availability, the prices for aircraft rose dramatically starting in the summer of 2021. Typically, aircraft lose 5 percent to 7 percent per year in value due to aging and the introduction of new aircraft with newer technology. Instead, the normal depreciation was replaced with raising prices.

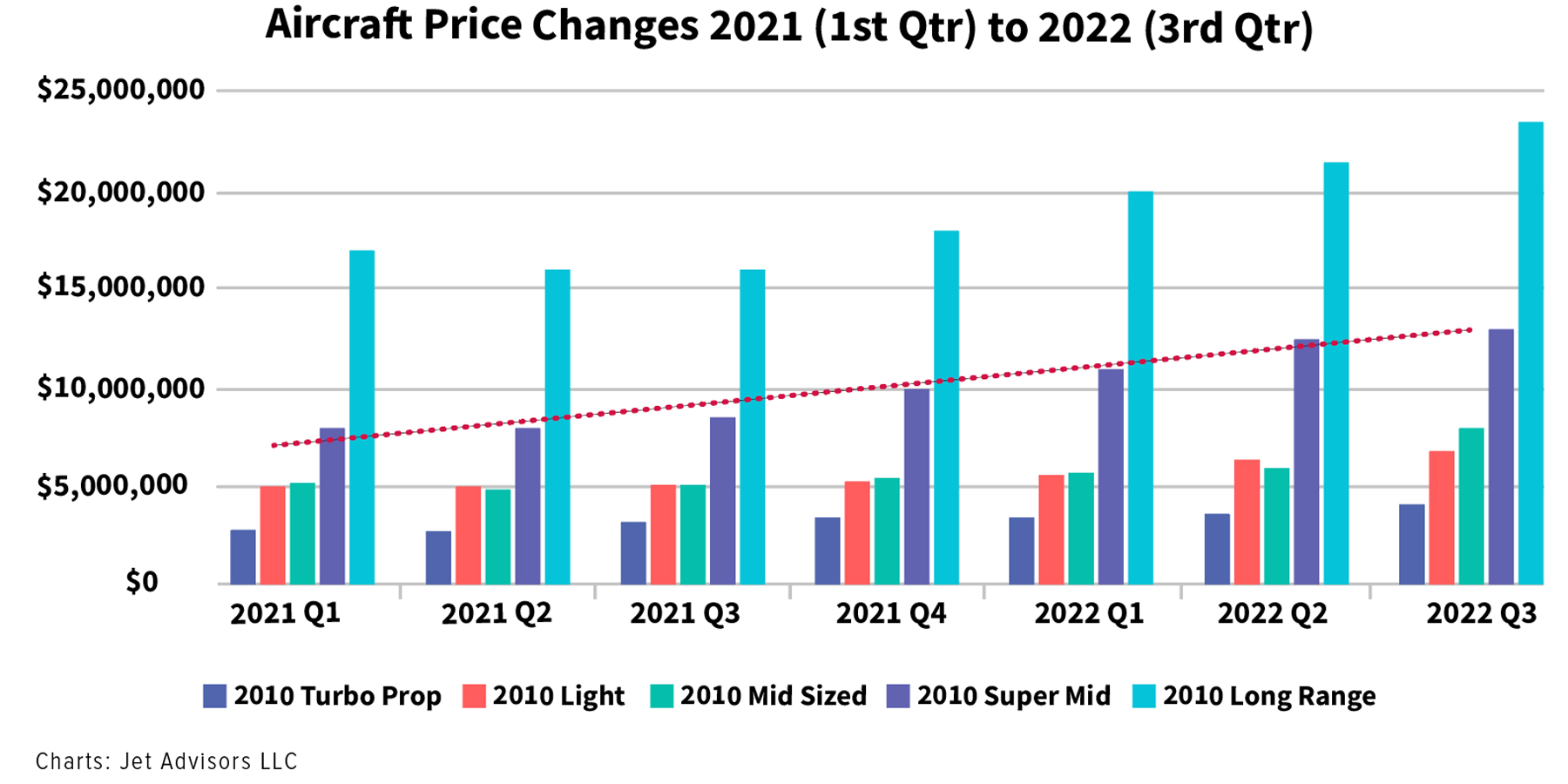

In the first quarter of 2021, with inventory down to 7 percent overall, pricing for a 2010 popular turboprop was about $2.6 million. By the third quarter of 2022, that same aircraft would cost over $4.1 million. This is about a 57 percent increase in value when typically, the market would have expected a 9 percent decline in value.

Pricing for a typical 2010-year model of a super-midsize jet was $8 million in the first quarter of 2021. By the third quarter of 2022, the price had risen by 63 percent to $13.1 million. While these are examples, the entire market has been affected by these increases. When the most popular aircraft in a category became unattainable, the aircraft in lower demand within the same category were subsequently sold. Much like when all the chocolate chip cookies are gone from the cookie platter, only then are the oatmeal raisin cookies consumed.

Long-range jets followed a different curve than many of the other categories but still managed a 50 percent overall increase in pricing over the review period. Long-range aircraft had strong demand in the first quarter of 2021 but suffered a dip for the next two quarters before increasing steeply over the subsequent 12 months. This may be because long-range jets are typically replacement jets and not a new demand, where smaller aircraft could have a mixture of replacement purchases and new-entrant purchases.

Moving forward, however, pricing trends could change. Late in the third quarter, the U.S. and the world economy were starting to show signs of weakness. The Dow Industrial Average had dropped several thousand points while interest rates had more than doubled. Combined with high levels of inflation and the cost of jet fuel, supply is likely to increase in the coming months. Pricing will likely fall as inventory levels increase.