Click Here to View This Page on Production Frontend

Click Here to Export Node Content

Click Here to View Printer-Friendly Version (Raw Backend)

Note: front-end display has links to styled print versions.

Content Node ID: 413083

Looking at some of the bold projections for world domination made by leading players in the advanced air mobility (AAM) sector, it could be tempting for some to come away with the view that the arrival of new eVTOL aircraft will signal the extinction of today’s helicopters. Some prospective eVTOL operators certainly view the electric-powered vehicles heading to market in various configurations including lift-and-cruise as alternatives to traditional rotorcraft but the relationship between the old and new waves is, in fact, more complex.

Front runners in the AAM gold rush say they are now just two years away from having eVTOL aircraft certified and starting commercial services in various early adopter cities expected to include Los Angeles, Miami, Dallas, and New York. Those companies include Archer (Booth B5058), Joby, Lilium, Eve, Vertical Aerospace, and Volocopter, with China’s EHang potentially beating them all to market, domestically at least, with its two-passenger EH216 autonomous vehicle.

Meanwhile, legacy helicopter manufacturers appear to be taking a somewhat more gradual, but nonetheless focused approach. Last year, Airbus started building the dedicated test center at Donauwörth in southern Germany, where it intends to start flying a full-scale prototype of the CityAirbus NextGen aircraft in 2023. It is already engaging with prospective operators and stakeholders in markets including Europe, Asia, and Latin America. In Japan, local helicopter operator Hiratagakuen is exploring plans to launch eVTOL flights in Kansai.

Jaunt Air Mobility (Booth 4861) hopes to bring its four-passenger Journey eVTOL into service in 2026, based on the company’s patented slow rotor compound design. Mint Air in South Korea, Italy’s Walle, and Vertiko in Canada stand among the prospective operators for the aircraft, which Jaunt expects to fly to a maximum range of about 100 miles.

After keeping its AAM sector plans under quiet for some time, Textron’s new eAviation division last year confirmed that Bell (Booth B5504) is working on its Nexus eVTOL design. The U.S.-based group also now includes European electric aviation innovator Pipistrel, which is working on multiple new models.

Sikorsky (Booth C1020) has yet to show its hand for any AAM plans it might conceivably introduce. A new generation of electric powertrains ranks at the top of the U.S. helicopter manufacturer’s technology priorities.

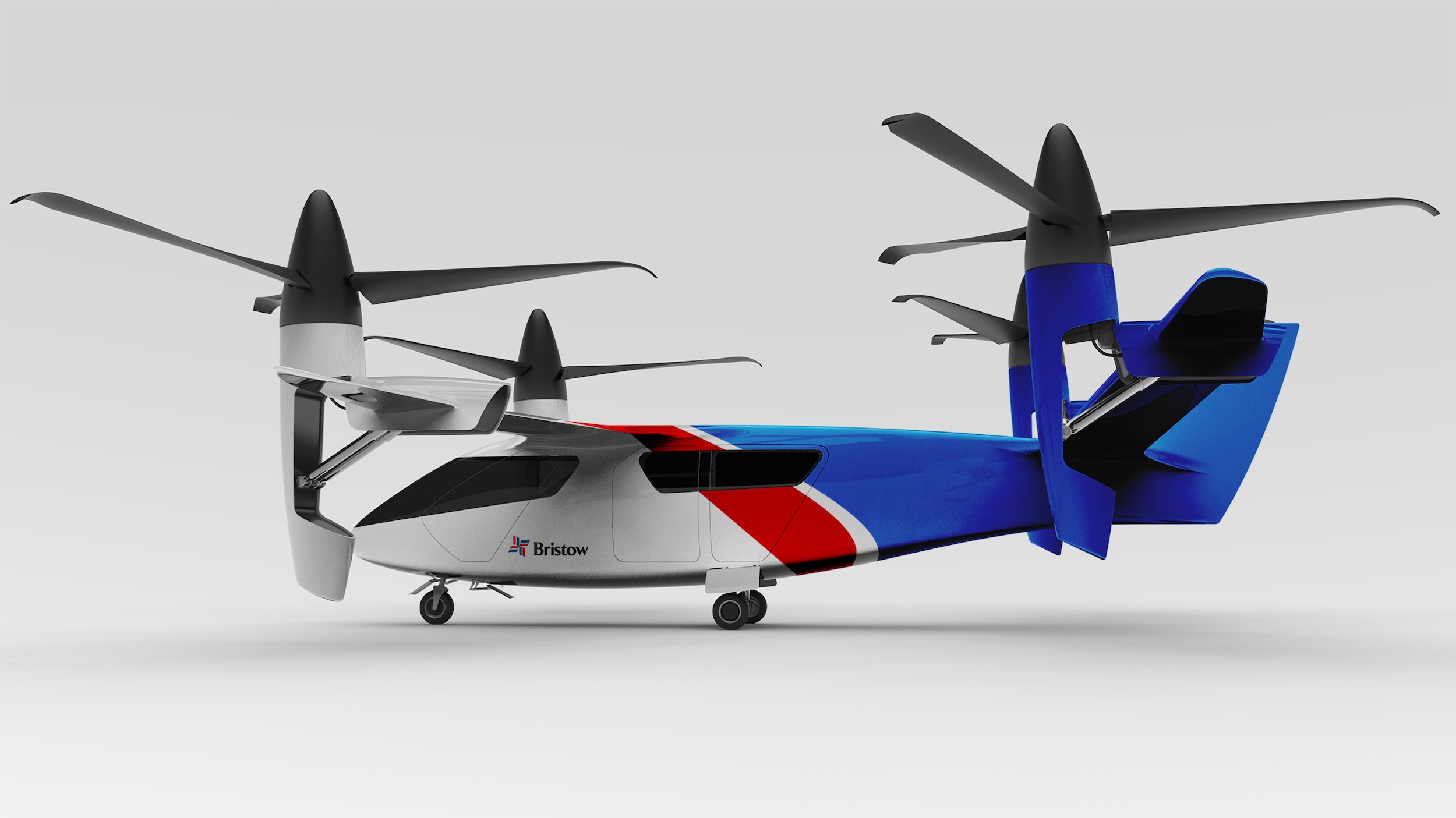

Major helicopter operator Bristow is one of the largest in the industry to make plans for an eVTOL future, having collected provisional sales commitments from Lilium, Eve, Overair, and Vertical Aerospace. The company also intends to add new eSTOL aircraft, including those under development by Electra and Elroy Air.

According to David Stepanek, Bristow’s executive vice president for sales and chief transformation officer, the new aircraft will complement its 250-strong helicopter fleet. Beyond the company’s core business of oil and gas industry support, it is also projecting expansion into areas such as middle-mile cargo deliveries and search-and-rescue services.

Rival operator Babcock also plans to deploy eVTOL vehicles for medical support roles. In July 2022 it formed a joint working group with Vertical Aerospace, which is developing a model called the VX4.

U.S.-based Bristow also sees potential to provide support to eVTOL aircraft manufacturers looking to start their own air taxi business models. With operations around the world, it could potentially support other companies in areas such as aircraft maintenance and pilot training.

Rideshare provider Blade Air Mobility also intends to include eVTOL vehicles in the fleets of its network of partner operators now flying helicopters. It has confirmed sales commitments with Eve Urban Air Mobility Solutions for its four-passenger aircraft, and also with Beta Technologies and Boeing-backed Wisk. In August 2022, Blade and Eve, in which Brazilian aircraft manufacturer Embraer is the main shareholder, conducted a simulation of air taxi operations in Chicago using helicopters to demonstrate how traffic would flow.

In the Gulf region, helicopter operators including Falcon Aviation and Abu Dhabi Aviation (Booth C4436) are laying plans to be involved in the AAM sector. Falcon expects to launch air taxi flights using Eve’s four-passenger aircraft from the luxury Atlantis The Palm resort in Dubai, where VPorts at Al Maktoum International Airport continues to work toward establishing an AAM business park.

If eVTOL operations proliferate at the extraordinary rate predicted by their backers, the new sector will face an enormous pilot recruitment challenge at a time when supply is already squeezed. Flight training group CAE (Booth B6810) is preparing to help fill the gap with plans to develop new simulators and develop programs based on requirements that regulators have yet to fully define. The company is already working with eVTOL developers Joby, Volocopter, Jaunt, and Joby. Logistics group DB Schenker (Booth C3100) is another would-be early adopter of eVTOL vehicles, in its case for freight distribution. The German company is working with its compatriot Volocopter on plans to use its VoloDrone for cargo operations.

Kaman (Booth B5620) continues to test its Kargo UAV logistics, with the U.S. Marine Corps having signed a contract with the company to build a prototype for demonstration and evaluation purposes. The aircraft, which is powered by the R300 turboshaft engine developed by Rolls-Royce (Booth B4813) for light helicopters, would fly to a range of 500 nm carrying an 800-pound payload.

Meanwhile, efforts to convert existing helicopters to electric propulsion have gained momentum. In 2022, Tier 1 Engineering achieved a first flight with a Robinson R44 on which a MagniX 350 electric propulsion system replaced the helicopter's piston engines. Lung Biotechnology, which is part of the United Therapeutics group, has agreed to serve as the launch customer for the aircraft, which will have an initial flight endurance of about an hour and could be used for carrying organs for transplant procedures.

Leonardo (Booth B1005), which is making the fuselage for the Vertical Aerospace eVTOL model, plans to market a hybrid-electric light helicopter for service during the second half of this decade. The Italian manufacturer plans to use its new AW09 rotorcraft as the technology demonstrator for this program.

The exhibitors list for this week’s HeliExpo 2023 show also includes numerous companies engaged in the development of new eVTOL and eSTOL aircraft with propulsion, avionics, and airframe technology. They include Collins Aerospace (Booth B3920), Garmin (Booth B5020), GE Aerospace (Booth C5023), Honeywell (Booth B808), Qarbon Aerospace (Booth C1213), Safran (Booth C2109), and Thales (Booth B4630).

The FAA (Booth B3555), which is taking a lead role in developing airworthiness and operating requirements for the new aircraft, is also present in Atlanta. The agency nearly has finalized the means of compliance for type certifying the eVTOL aircraft in development at Archer and Joby, and they will likely set a blueprint for others. Authorities must also resolve the rules under which the new models will operate in commercial service and how they will integrate into controlled airspace alongside other aircraft.