Click Here to View This Page on Production Frontend

Click Here to Export Node Content

Click Here to View Printer-Friendly Version (Raw Backend)

Note: front-end display has links to styled print versions.

Content Node ID: 403777

For the first six months of 2020, it seemed that used helicopter prices were plummeting faster than a Maltese cliff diver.

The numbers coming out of 2020’s second quarter were abysmal. Soaring insurance rates, the global pandemic, and oil prices that collapsed to a record negative $37.63 per barrel—yes, people were paying you to take their oil—by April threw the worldwide commercial rotorcraft market into a miasma of unprecedented gloom.

“It’s the worst helicopter market in 40 years,” Jason Kmiecik, president of aircraft pricing specialist HeliValue$, said last summer. “There’s just a lot of bad things going on. It’s a bad time for everybody.” Overall helicopter flight hours dropped by 30 percent save for firefighting, a sector that enjoyed record demand in 2020.

Fortunately, the truly bad time didn’t last, but it is still firmly a buyer’s market. By Q3 2020, there were indications that it had begun to recover. And by year-end the numbers had improved enough that Aero Asset was characterizing the market as “resilient.”

Indeed, the used helicopter market recovered enough in the second half of last year to outperform dismal 2019 unit sales volumes, concluded the Toronto-based consultancy in its year-end 2020 market analysis. “Markets showed incredible resilience in Q3 and Q4,” the company noted. “Overall, 2020 preowned retail sales volume (number of units) rose by 10 percent year-over-year and 2020 saw the most retail transactions in the last four years.”

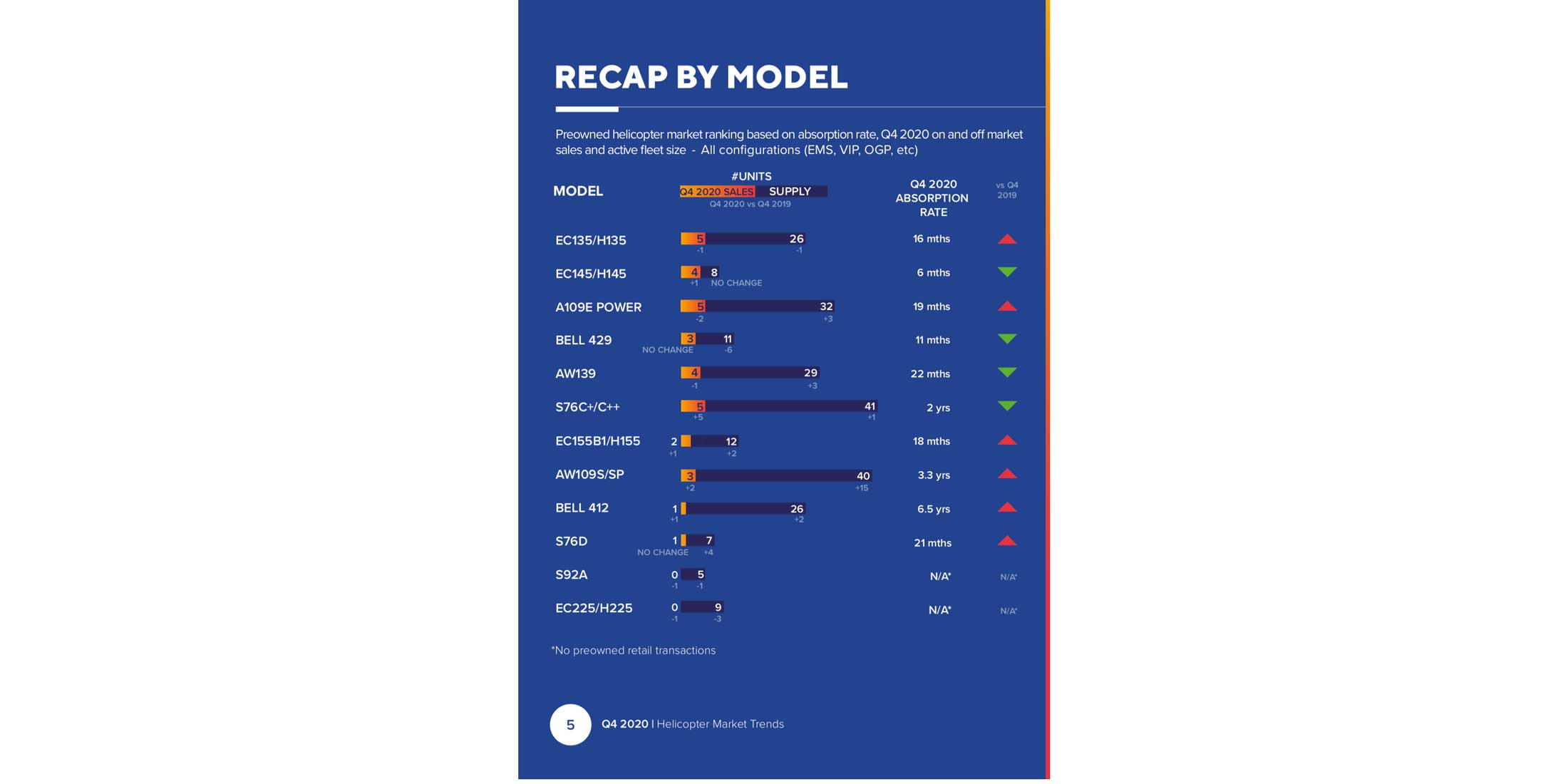

Aero Asset said supply rose 8 percent year-over-year and the overall absorption rate was fairly constant, contracting to 20.5 months from 21 months in 2019. Altogether, 143 used helicopters sold last year worth $516 million out of 245 offered for sale valued at about $1 billion.

The rebound was led by a sharp increase in both the prices and sales volumes for Sikorsky S-92 and Airbus H225 heavy twins, many of which had been parked after their values collapsed to near-scrap prices as demand evaporated with the contraction of the offshore energy market. Many of those helicopters have now returned to service, albeit with new owners and missions.

For all of 2020, 18 heavies changed hands—compared with just 10 in 2019—representing 12 percent of all units sold in 2020 and 20 percent of the aggregate transaction value for the entire used helicopter market. Their sale prices averaged $5.1 million.

Meanwhile, the medium twin sale price averaged $4.6 million and accounted for 40 percent of the used market’s value and 30 percent of units sold, with the Leonardo AW139 leading the way. Light singles and twins held steady, representing 58 percent of all units sold. Aero Asset forecasts that the used market will continue to improve in 2021.

Drop In New Helicopter Sales Not Aiding Used Market

The reduced demand for new helicopters does not seem to be buoying the used market to any great degree. For the year the major producers of civil helicopters all reported down numbers, both in terms of deliveries and new orders. According to data from the General Aviation Manufacturers Association (GAMA), among OEMs Robinson, Leonardo, Bell, and Airbus, deliveries of new civil helicopters plunged from 564 for the first three quarters in 2019 to 426 for the same period in 2020. Among the smaller OEMs such as Helicopteres Guimbal and Enstrom, the drop was even more dramatic. By way of context, the top four civil OEMs delivered 651 units in the first three quarters of 2017.

Airbus Helicopters 2020 results included 289 gross orders (net: 268) and 300 deliveries that amount to a 48 percent share of the world civil and parapublic market. These numbers are down from 2019 when the company posted 369 orders and 332 deliveries to achieve a 54 percent market share. Nevertheless, thanks to increasing service revenues and a strong military book of business, Airbus Helicopters was able to increase 2020 revenues by 4 percent over 2019. Leonardo Helicopters saw a 50 percent drop in first-half deliveries year-over-year.

“For civil helicopters, demand will not get back to 2019 levels for some time,” said Leonardo CFO Alessandra Genco. During the first six months of 2020, Leonardo delivered 30 helicopters, down from 61 from the same period in the previous year. For the year, Leonardo delivered 111 helicopters, down from 156 in 2019, a drop of 29 percent.

Fewer commercial helicopter deliveries contributed to lower revenue and profit at Bell in the fourth quarter, parent company Textron reported. Commercial deliveries during the three-month period totaled 57, compared with 76 in the same period a year earlier. For all of 2020, Bell delivered 140 commercial helicopters versus 201 in 2019.

Key sectors of the rotorcraft market—offshore energy, air ambulance, and law enforcement—continue to exhibit signs of stress going into 2021, which will likely continue to depress used helicopter prices.

Offshore Energy Shedding Aircraft

Recapitalized following its emergence from bankruptcy and subsequent merger with Era last year, offshore helicopter services company Bristow Group continues to post substantial quarterly losses and shed helicopters. For the quarter ending December 31, Bristow posted a loss of $57.1 million on operating revenues of $300.3 million, compared with a loss of $27.9 million on revenues of $295.7 million in the preceding quarter. Bristow is continuing to “right-size” its aircraft inventory, disposing of five Sikorsky S-76C++ medium, two Bell B412 medium, and seven Bell B407 single-engine helicopters, in addition to one Airbus H225 simulator in the fourth quarter. During the preceding quarter, the company sold 10 Airbus H225 heavy, nine S-76C++ medium, and 12 Bell 407 single-engine helicopters for cash proceeds of $40.5 million. “For calendar 2021, we're really not counting on any broad-based significant increase above where things are today,” said Bristow CEO Chris Bradshaw in February.

While oil prices have stabilized in recent weeks, this leveling is nowhere near enough to restore long-term financial health to the offshore sector, with allegations of contracts being maintained and won below costs in some cases. Bristow’s Bradshaw is repeating his call for consolidation. “We continue to believe that the industry needs and would benefit from additional consolidation," he commented in February. "A lot of the rationale that underpins the logic of the Bristow Era merger would apply in other combinations in different parts of the world where there is an excess amount of capacity, too much equipment, too many operators.”

Following Bristow’s lead, CHC Helicopters recently acquired Babcock’s offshore helicopter business in the UK, Denmark, and Australia, a deal covering 29 helicopters. Prior to that announcement, Babcock had taken special charges of $118.5 million in 2020 and set aside another $7.285 million for “loss-making contracts” related to its aviation business.

While the offshore market is going to get off the seabed, it will be a slow ascent, with the offshore drilling market forecast to grow by $11 billion between now and 2024, mostly in deepwater areas.

For helicopter services companies, offshore wind continues to hold promise for helicopter service growth and perhaps $1 billion worth of new aircraft, according to a study from Air & Sea Analytics—even as hundreds of wind turbines failed during the recent U.S. arctic blast. However, that growth will be gradual between now and 2030. Nevertheless, the helicopter service companies are taking a hard look at it. Bristow’s Bradshaw called it a “strategic priority,” while acknowledging it would require a different equipment mix—mostly light and medium twins—as opposed to the intermediates to heavies that currently dominate offshore energy support.

Helicopter Air Ambulance Market in Hover

Like offshore energy, the future of the U.S. air ambulance market is opaque. Long-term, the industry’s current business model is not sustainable—with some 70 percent of transports either Medicare or Medicaid patients whose rides are reimbursed by the government at rates that are on average 72 percent below costs, costs that have increased due to increased Covid precautions and protocols. And as the baby boom generation continues to expand while rural medical care contracts, that disparity will only grow. In recent years, the number of providers has shrunk as smaller operations are acquired and assimilated into two main operators, owned by private equity firms, that collectively are responsible for 64 percent of all Medicare transports, according to the Brookings Institution. Those two firms make up for the shortfall in government reimbursement rates by charging up to seven times as much as those reimbursements per transport to uninsured or privately insured patients, according to Brookings—an increase of 79 percent between 2012 and 2017, to an average per transport charge of nearly $50,000.

Predictively, some private insurers have pushed back, by either denying or forestalling payment claims or by refusing to negotiate “out of network” payment agreements with air ambulance operators. While Air Methods reports that “in-network” agreements with insurers now cover 50 percent of its privately insured transports, several of the nation’s largest health insurance companies still refuse to enter into them. “No surprise billing” federal legislation recently enacted into law could offer some relief for operators seeking payment from health insurers. The ultimate results will hinge on complex, multi-federal agency enabling rules, which are not expected until next year. Meanwhile, operators continue to close bases where there is an unfavorable mix of government-insured patients.

All of this translates into reduced capital spending throughout the sector and fewer new helicopter purchases. Perhaps as a harbinger of this, Air Methods recently enrolled 111 of its helicopters in the Airbus HCare contract maintenance program.

De-rotor the Police

The parapublic sector also appears poised to take a hit. Police aviation programs have always been low-hanging fruit for municipal budget-cutters, but recent calls to “defund the police,” in the wake of increased urban unrest and violence, as well as Covid-induced local revenue shortfalls, are putting new pressures on law enforcement helicopter programs. Cuts to police helicopter programs are under consideration from Ocean City, Maryland to San Diego, California.

Political leadership in major cities, including New York and Los Angeles, are cutting police funding. New York City comptroller Scott Stringer wants the $5.9 billion annual police budget there cut by $1.1 billion over the next four years. New York operates a fleet of eight police helicopters. In Los Angeles, the police department is facing a $150 million funding reduction this year. LAPD, which operates the largest municipal police aviation unit in the U.S., has said the cut will be partially born by its air support unit. Aviation unit budget reductions are generally taking the shape of reduced flight hours, fleet downsizing, and deferred maintenance and modifications.

Grounded Air Tours

Helitourism holds the unfortunate distinction of being the most egregiously impacted sector by the pandemic, being either forced to suspend operations by state authorities or doing so out of necessity as tourists evaporated.

Sundance Helicopters permanently closed its air-tour operations in August, citing a pandemic-induced steep drop in tourism in the Las Vegas area that had forced it to close for commercial tours for several months earlier in the year. "The continued loss in revenue and lack of visitors to Las Vegas necessitated the decision to permanently close," the Air Methods division said in a Facebook post. Originally branded “Helicopter Services of Nevada,” Sundance had by 2019 grown its fleet to 29 aircraft and had more than 200 employees. The former included Airbus EC130B4/T2s, AS350B2s, and a Cessna Caravan. The payroll consisted of 40 maintenance technicians and 10 maintenance support personnel, as well as 35 full-time and about 18 seasonal pilots. A month after the Sundance announcement, fellow Las Vegas helitour companies decided to stay in the game, albeit with large-scale layoffs. Maverick said it was laying off 75 employees; Papillon announced it was furloughing 100 for six months or longer.

The Chicago Helicopter Experience made permanent the temporary closure it had announced in March 2020. The company said that after eight years in business, “overnight it was all erased.” Tour operators resumed flights in the New York City area, but in many cases were forced to offer deep discounts to attract clientele. “Shoe selfie” FlyNYON tours chopped prices by 50 percent. And although helicopter flight operations were curtailed in Gotham, during the mandatory lockdowns helicopter noise complaints there doubled as more residents were homebound. In Hawaii, state edicts grounded helitours through October and ongoing Covid protocols mean operators fly fewer tours due to between-flight aircraft sanitizing and passenger health checks.

Impact By Class

With relatively few exceptions, none of this is good for the resale market, particularly at the bookends of light singles and heavy twins. A conglomeration of valuations from the major helicopter price-tracking services as well as Vref over the last six months indicates a rapid plunge in prices—of up to 30 percent or more—that began as the impact of the Covid shutdown began to spread from Q2 2020 through the end of the year.

Turbine Singles

Among the light singles, the prices of ubiquitous Airbus A-Stars dropped 12 to 19 percent, with 2010 AS350 B2s taking the worst hit. That was minor compared with the plunge posted by a decade-old example of the discontinued EC-120B, down 28 percent to just $705,000. Values of older EC-130B4 Eco-Stars held steady, but an updated 2018 H130 fell 17 percent to $2.5 million.

A 20-year-old Bell 206 B3 can now be had for less than $500,000, while the same vintage, longer 206L-4 is typically priced well under $1 million, dropping 19 percent in the last half of 2020. A late-model 2015 Bell 407 GXP lost nearly 20 percent of its value, to near $2 million. Prices of five-year-old Leonardo AW119Kx singles lost 46 percent of their value, just shy of $1.4 million. Same-year Robinson R-66s declined 21 percent to just under $600,000, while the same-year Bell 505 is down 9 percent to around $850,000. A decade-old Enstrom 480B fell around 6 percent, trading at $680,000. A relatively short supply has enabled MD 500 and 600 series produced over the last 10 years to hold steady, trading in the $1.2 million to $1.7 million range.

Light Twins

Airbus EC-135 and EC-145 twins are holding their value well, reflecting on their continuing popularity among air ambulance operators. Within the group, those EC-135s equipped with Pratt & Whitney Canada engines appear to list for somewhat higher prices. Incongruously, five-year-old EC-145s are selling for less than the same-year EC-135. Trending older, a 2000 BK117 dropped 34 percent and now fetches less than $900,000. A five-year-old Bell 429 lost 21 percent of its value and now can be had for prices approaching $4 million. Prices of 2007-era MD902s held steady just below $2 million. A 10-year-old Leonardo AW109S was off 10 percent, to $2.3 million.

Medium & Intermediate Twins

In a class that is traditionally thinly traded, the Airbus EC-155 is still looking for the floor, with 2010 models breaking through $2.6 million, a 33 percent plunge, while 2015 models are trading around $6.8 million, a 34 percent drop. Vintage Bell 430s are holding steady around $1.5 million, while Bell 412s of all ages are fire-saled, with a 2010 412EP diving 45 percent to $3.9 million. The highly prized Leonardo AW139 shouldered a major price hit at the start of offshore oil’s 2018 dirge. Over the last two years, a 2010 model has commanded between $4.5 million and $5 million. The value of a somewhat smaller, late-model 2018 AW169 is off 28 percent, down to just above $6 million. Sikorsky S-76s, regardless of the vintage, are priced to move: a 1995 S-76B is now trading below $800,000 while the newer 2015 S-76D is priced around $6 million, a 39 percent drop from Q2 2020.

Super-Mediums

The collapse of oil prices triggered a price carnage in heavy twins. That has made the super-medium space a lonely place for its sole occupants, the Airbus H175 and the Leonardo AW189. The raison d’etre for those machines was to offer a more cost-efficient alternative to bigger helicopters, particularly for the deepwater offshore energy market. But due to the dive in valuations of the larger heavies, the efficient super-mids have not sold as well as their manufacturers had hoped. And even with their lower operating costs, they cannot match the overall costs of their larger-sized competitors that continue to sell for basically liquidation prices (see below). Until the prices for heavies stabilize, the super-mids will be trapped in a brutal market downwash, with five-year-old aircraft that are on the market commanding less than half of their original sales price. Considering an H175 sold new for around $17 million in 2015, that’s a pile of depreciation.

Heavy Twins

This is another category of two. By last August, 39 Sikorsky S-92s, comprising 19 percent of the global market, were parked. Among the active fleet, flying hours were down 27 percent, according to Air & Sea Analytics. The firm noted that offshore helicopter services companies Babcock, Bristow, CHC, and Lider were returning aircraft to lessors against the backdrop of one-quarter of the world’s mobile offshore oil rigs being scrapped since 2015. Leasing company Milestone is facing the largest exposure, owning nearly 100 S-92s, more than one-third of the total S-92 fleet. Milestone’s parent, GE Capital Aviation Services (GECAS) wrote down the value of the company by $729 million in July, a move seen in large part as reflecting the reduced market value of its S-92 fleet. The write-down represents a 41 percent devaluation of the $1.775 billion GECAS paid to acquire Milestone in 2015. GE subsequently announced a deal to sell all of GECAS to AerCap earlier this month and AerCap’s intentions with regard to the helicopter lessor have yet to be announced.

The outlook for the S-92 could have been worse had Sikorsky not taken significant actions in recent years to reduce the cost of S-92 operation, such as reducing AOG turnaround time by two-thirds, implementing better forward stocking of parts, adding authorized service centers, increasing the intervals between major inspections, and adding real-time health usage and monitoring. Sikorsky also unveiled plans to offer significant upgrades for the S-92A beginning in 2023 in the form of the “A+” upgrade, which includes a menu of items such as a new and more robust main gearbox; an increased gross weight kit to 27,700 pounds; an uprated engine, the GE CT7-8A6, that offers better payload capability and high and hot performance and enables “seats full, full fuel” under most conditions; and Matrix advanced flight computing hardware and software. Matrix enables other new Sikorsky technology such as Rig Approach 2.0 and SuperSearch. For offshore missions, Rig Approach permits the helicopter to fly a mission profile to within a quarter-mile of the helideck on an oil rig.

And while the value of a 2015 S-92 dropped from $17 million to $11 million in the last six months of 2020, that is still almost double the price of a comparable Airbus Super Puma class (H225, EC-225, AS322), an aircraft trapped in a reputational rotorwash following a series of fatal crashes and a worldwide 2016 fleet grounding that lasted five months.

Airbus’s own 2017 survey found that 62 percent of respondents would not fly the Supa Puma and the North Sea offshore oil workers union, Unite, gathered 10,000 signatures in support of permanently grounding the helicopter. Over the last several years, Airbus has settled a good chunk of the attendant civil litigation spawned from accidents, the grounding, and resultant and rapid depreciation. The company has also worked hard with banks, lessors, and operators to repurpose the aircraft from passenger missions into government contracts, and heavy lift and cargo operations. These efforts have met with some success. In February, leasing company Milestone announced a deal to place 11 H225s with Air Center Helicopters, Inc. (ACHI) to be used for U.S. government seaborne replenishment and transport contracts. In 2018, Airbus began deliveries of 21 repurposed H225s to the Ukrainian National Guard.

The repurposing efforts appear to be breathing life into a model that was all but dead. The resale value of 2015 EC-22LP, which sold for $21.5 million new, had plunged to $3.5 million by the middle of 2020 but has since rebounded to $6.5 million.

Still, despite these yeoman efforts to restore value to heavy twins, customers remain far from enthusiastic when it comes to acquiring new examples. Customers booked orders for just four new H225s last year, and Airbus shelved plans for a modern heavy twin, the X6, in 2018 after concluding the market was “not sustainable.” Sikorsky sales of new S-92s are likewise lackluster, but the company is continuing plans to offer its S-92B, a modernized derivative with improvements including larger cabin windows, beginning in 2025.

For the first six months of 2020, it seemed that used helicopter prices were plummeting faster than a Maltese cliff diver.

The numbers coming out of 2020’s second quarter were abysmal. Soaring insurance rates, the global pandemic, and oil prices that collapsed to a record negative $37.63 per barrel—yes, people were paying you to take their oil—by April threw the worldwide commercial rotorcraft market into a miasma of unprecedented gloom.

“It’s the worst helicopter market in 40 years,” said Jason Kmiecik, president of aircraft pricing specialist HeliValue$ said last summer. “It’s a bad time for everybody.” Overall helicopter flight hours dropped by 30 percent save for firefighting, which enjoyed record demand in 2020.

Fortunately, the really bad time didn’t last, but it is still firmly a buyer’s market. By Q3 2020, there were indications that it had begun to recover. And by year’s end the numbers had improved enough that Aero Asset was characterizing the market as “resilient.”

The used helicopter market recovered enough in the second half of last year to outperform dismal 2019 unit sales volumes, concluded the Toronto-based consultancy in its year-end 2020 market analysis. “Overall, 2020 preowned retail sales volume (number of units) rose by 10 percent year-over-year and 2020 saw the most retail transactions in the last four years.”

Aero Asset said supply rose 8 percent year-over-year and the overall absorption rate was fairly constant, contracting to 20.5 months from 21 months in 2019. Altogether, 143 used helicopters sold last year worth $516 million out of 245 offered for sale valued at about $1 billion.

The rebound was led by a sharp increase in both the prices and sales volumes for Sikorsky S-92 and Airbus H225 heavy twins, many of which had been parked after their values collapsed to near-scrap prices as demand evaporated with the contraction of the offshore energy market. Many of those helicopters have now returned to service, albeit with new owners and missions.

For all of 2020, 18 heavies changed hands—compared with just 10 in 2019—representing 12 percent of all units sold in 2020 and 20 percent of the aggregate transaction value for the entire used helicopter market. Their sale prices averaged $5.1 million.

Meanwhile, the medium twin sale price averaged $4.6 million and accounted for 40 percent of the used market’s value and 30 percent of units sold, with the Leonardo AW139 leading the way. Light singles and twins held steady, representing 58 percent of all units sold. Aero Asset forecasts that the used market will continue to improve in 2021.

The reduced demand for new helicopters does not seem to be buoying the used market to any great degree. For the year the major producers of civil helicopters all reported down numbers, both in terms of deliveries and new orders.

Key sectors of the rotorcraft market—offshore energy, air ambulance, and law enforcement—continue to exhibit signs of stress going into 2021, which will likely continue to depress used helicopter prices.

While oil prices have stabilized in recent weeks, this leveling is nowhere near enough to restore long-term financial health to the offshore sector, with allegations of contracts being maintained and won below costs in some cases. Bristow CEO Chris Bradshaw is repeating his call for consolidation. “We continue to believe that the industry needs and would benefit from additional consolidation," he commented in February.

For helicopter services companies, offshore wind continues to hold promise for helicopter service growth and perhaps $1 billion worth of new aircraft, according to a study from Air & Sea Analytics—even as hundreds of wind turbines failed during the recent U.S. arctic blast. However, that growth will be gradual between now and 2030.

Like offshore energy, the future of the U.S. air ambulance market is opaque. Long-term, the industry’s current business model is not sustainable—with some 70 percent of transports either Medicare or Medicaid patients whose rides are reimbursed by the government at rates that are on average 72 percent below costs, costs that have increased due to increased Covid precautions and protocols.

The parapublic sector also appears poised to take a hit. Police aviation programs have always been low-hanging fruit for municipal budget-cutters, but recent calls to “defund the police,” as well as Covid-induced local revenue shortfalls, are putting new pressures on law enforcement helicopter programs. Cuts to police helicopter programs are under consideration from Ocean City, Maryland, to San Diego, California.

Helitourism holds the unfortunate distinction of being the most egregiously impacted sector by the pandemic, being either forced to suspend operations by state authorities or doing so out of necessity as tourists evaporated.