Click Here to View This Page on Production Frontend

Click Here to Export Node Content

Click Here to View Printer-Friendly Version (Raw Backend)

Note: front-end display has links to styled print versions.

Content Node ID: 406783

Blade Air Mobility posted strong revenue growth last year and CEO Rob Wiesenthal told AIN that he expects the trend to continue. “We were pleasantly surprised on the revenue side where we beat pretty much all the analysts’ estimates. We restarted our airport [shuttle] products and started beating—on a run-rate basis—the 2019 pre-pandemic number of flights to JFK [airport] and back. Leisure routes that only used to run on weekends have become seven-day-a-week businesses.”

Meanwhile, Wiesenthal said, the company's financials were “substantially improved.” Revenues for the year increased 156 percent, to $67.2 million. In the fourth quarter, revenues jumped 208 percent year-over-year, to $24.6 million, and were up 371 percent from the same period in 2019. Blade reported that “short distance” revenues soared 191 percent, to $6.2 million, in the quarter. Although Blade remains in a mode that focuses market growth over profitability, Blade still managed to post an $800,000 profit in the fourth quarter.

In addition, the company has plenty of cash reserves. In May it raised an estimated $365 million via a special purpose acquisition company (SPAC) combination with Experience Investment Corp. and became a publicly-traded company with a current market capitalization of more than $500 million. Some analysts expect the price of its stock to more than double in the coming year as eVTOLs and urban air mobility infrastructure march closer to market reality.

Buoyed by fresh capital, Blade made several significant growth moves last year, including the acquisition of Trinity Air Medical and folding it into Blade’s fast-growing MediMobility organ transport unit. It also paid $12 million to acquire Richmond, British Columbia-based Helijet’s passenger routes.

The Trinity acquisition in September made Blade the largest transporter of human organs for transplant in the U.S. Wiesenthal said using helicopters for organ transport hospital-to-hospital as opposed to a mix of ground and air transport not only can save time but can cut the cost of transport by up to 75 percent. “There’s a lot of growth opportunity there,” he said.

Addressing the Helijet deal, Wiesenthal said the operator already has a well-established passenger business in the Pacific Northwest. “Pre-pandemic, they were flying well over 125,000 people a year, and that has tuned out to be a great acquisition for us,” he noted.

Blade is looking to expand into other markets as well, including South Florida. “We believe in South Florida there is a real understanding and appreciation of helicopters and excitement to make the transition to eVTOL. We are hard at work looking at our opportunities in South Florida,” according to Wiesenthal.

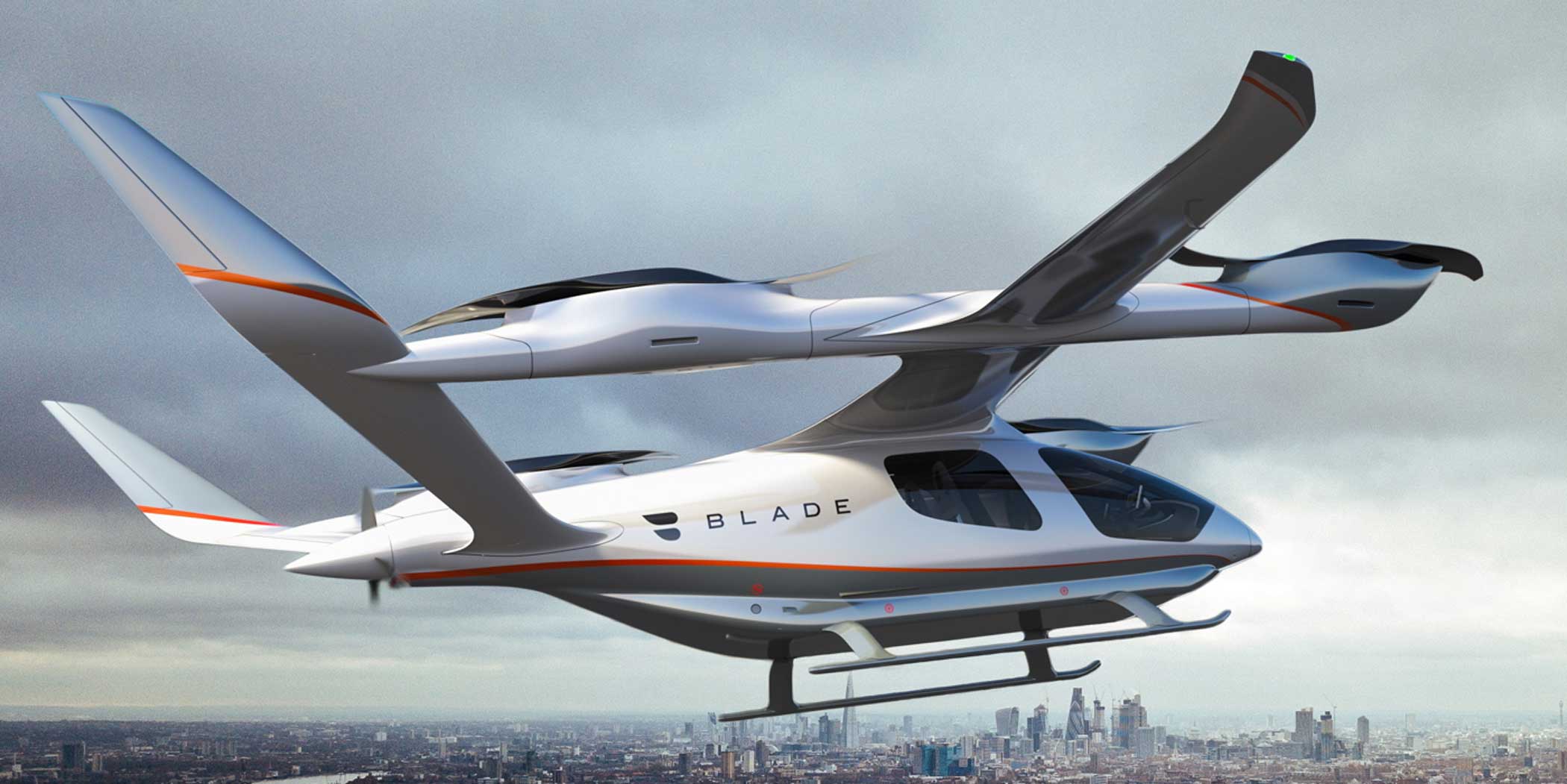

Over the past several years, Blade has announced deals with a variety of eVTOL manufacturers, including Beta and Embraer’s Eve. Last year, Blade said it would take up to 20 Beta Alia 250 eVTOLs, with deliveries starting in 2024 for operations beginning in 2025. Those aircraft will be acquired through “third-party financing relationships” with operators and be used to service routes from company terminals primarily in the Northeast U.S. where Beta will install rechargers.

Meanwhile, Eve expects to provide 60,000 eVTOL flight hours to Blade operating partners beginning in 2026 for use in the South Florida and California markets.

Wiesenthal sees quieter eVTOLs as one part of the solution to the ongoing helicopter noise debate in places like New York City and Los Angeles and thinks their introduction will garner wider political acceptance and further drive market demand.

“New York City mayor Eric Adams is more supportive of the helicopter business. He is really pro-business and wants City 2.0 to be a reality. He understands the infrastructure that Blade has in the city is critical to the transition to using electric vertical aircraft," Wiesenthal said. “He wants to be in that business and wants us to improve the attractiveness of Manhattan. We’ve seen people move to Florida and elsewhere and he wants those people to come back. And one way to do that is by having short-distance aviation by helicopter to reduce [ground] traffic, which is now above pre-pandemic levels in New York City. He is extremely enthusiastic about our transition to [electric vertical aircraft] and very supportive of our business overall.”

According to Wiesenthal, the New York City market still has plenty of room to grow. “In New York, 28 million people go between Manhattan and the airports by car. So there is a huge market for flying people, substituting a two-hour drive for a five-minute flight for $95 or $195 and shattering that Uber Black price barrier and matching Uber X during peak times,” he said. “So we see a tremendous amount of growth between where we are now and the [eventual] market size of getting people to the airports. Right now we are only doing it from one heliport to JFK and Newark, but we will be adding La Guardia at some point and near area heliports. We also see a business opportunity in the Northeast corridor Philadelphia-Boston route.”

Wiesenthal also envisions Blade’s last-mile passenger service as an important contributor to the company’s overall strategy. “Last mile and first mile are incredibly important. We actually have our own taxi and limousine service certification base here. We are allowed by the city to arrange ground transport for our customers, which was a very arduous task.

“I think at the end of the day given that this is not the Jetsons and won’t be for a number of years—we are not landing on top of your building. To the extent you need to get to a Blade terminal, we should be able to arrange that for you—you shouldn’t have to piecemeal your trip. A good portion of our customers is using Blade Essential Ground Connect, safe SUVs with HEPA filters and Plexiglas partitions. We already provide that free of charge at airports to get people from the helicopters to their commercial terminal. And we recently announced with [FBO] Signature a Blade subterminal inside Signature Newark that will help us process a lot more passengers and provide for a better passenger experience.”

Helicopters will continue to drive Blade’s near-term market growth, and that picture is looking up. Blade’s flight margins were 16 percent in the fourth quarter, up from 11 percent in the comparable 2019 period. The company attributed the improvement to greater use of Blade airport services and increased sector contributions from other business lines, including its organ transport and jet businesses.

The pandemic also drove some of this improvement, as customers began using the service to facilitate more frequent commuting between New York City and second homes in places such as the Hamptons. “There’s no such thing as a weekend anymore during the pandemic. [Before the pandemic] we could have 14 helicopters going back and forth to one destination on Thursday and Friday and those helicopters were very dormant on Tuesdays and Wednesdays,” Wiesenthal said.

”Now everything is spread out [during the week] and that is better for our operators because you are getting better utilization from fewer helicopters and fewer pilots, as opposed to having to staff for peak demand. Our operator partners should be enjoying the benefits of that,” he said, adding that some operators have had to add helicopters to accommodate the overall increased demand during the pandemic. “We have definitely increased the number of aircraft being used by some of our operators, and as we move into new regions we expect that to continue this year.”

Blade responded to the demand by issuing commuter passes for $295 that cover flight segments up to 100 miles. “The pandemic cut both ways,” explained Wiesenthal, noting that certain Covid precautions and the interruption of airport service increased costs.

“Pre-vaccine we had to administer mandatory [passenger] blood oxygen and temperature checks and electrostatic decontamination of aircraft, and that became very expensive. We pulled back from that now and require mandatory vaccination for all our flights. But net-net it presented more of a demand issue for certain products more than a cost issue,” he said. “In some places it increases your flight volume and in other places it doesn’t.”