Click Here to View This Page on Production Frontend

Click Here to Export Node Content

Click Here to View Printer-Friendly Version (Raw Backend)

Note: front-end display has links to styled print versions.

Content Node ID: 419058

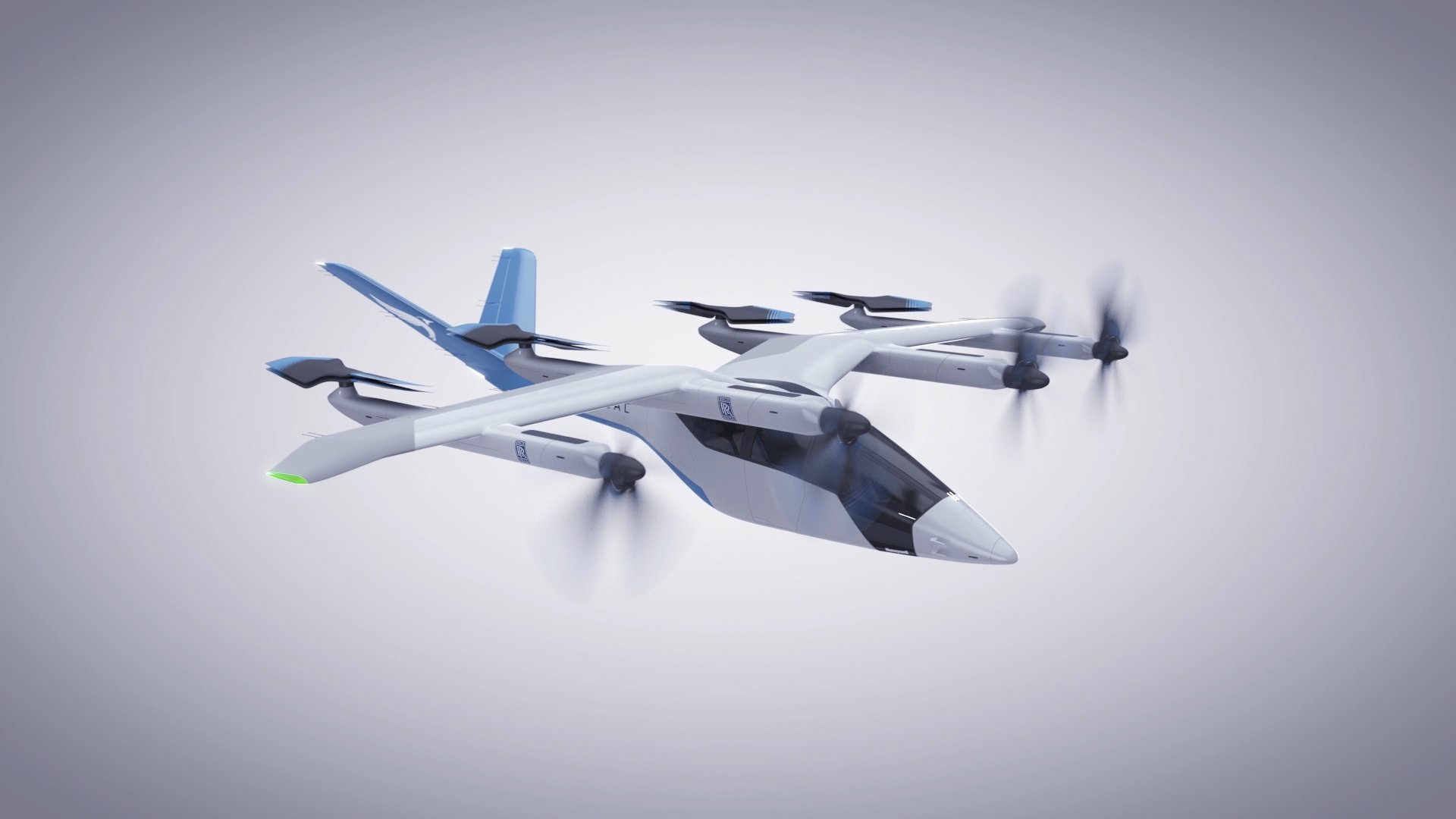

American Airlines, Virgin Atlantic, and leasing group Avolon have committed to buying up to 1,000 of Vertical Aerospace’s VA-X4 eVTOL aircraft. The deals announced late on June 10 are potentially worth up to $4 billion for the UK-based manufacturer and represent the largest sales agreements placed so far in the emerging advanced air mobility sector.

At the same time, Vertical announced plans for an initial public offering on the New York Stock Exchange through a merger with special purpose acquisition company Broadstone Acquisition Corp. The transaction, which is expected to close in the second half of 2021, could value the company at between $1.8 billion and $2.2 billion based on a $10 share price for the public investment in private equity (PIPE), generating gross proceeds of $394 million.

American and Avolon, along with Honeywell and Rolls-Royce, are also investing in the PIPE. They will join existing strategic backers in Vertical, including Microsoft’s M12 investment arm, 40 North, and Rocket Internet SE.

American is investing $25 million, but the other new backers have not disclosed how much capital they are providing. Honeywell and Rolls-Royce are already partners in the program, supporting plans to complete EASA type certification of the four-passenger, all-electric VA-X4 aircraft in 2024. Other partners include GKN Aerospace and Solvay.

Under the terms of the pre-orders placed on June 10, American has provisionally agreed to take 250 aircraft, with options for 100 more. Avolon has committed to 310 aircraft, plus options for a further 190. American intends to work with Vertical to develop passenger operations and infrastructure in the U.S. market.

Virgin Atlantic, which is to buy between 50 and 150 aircraft says it intends to launch a network of short-haul scheduled services in the UK with the aircraft on routes of up to around 120 miles. The services will operate from hubs at London’s Heathrow and Gatwick airports, as well as Manchester. The aircraft is projected to operate at speeds of up to 200 mph.

Vertical claims its business will achieve profitability and cash flow breakeven on annual sales of less than 100 aircraft by 2024. Based on the announced agreements, the list price for the VA-X4 would appear to be $4 million.

Bristol-based Vertical was founded in 2016 by Stephen Fitzpatrick, who is the founder of energy retailer Ovo. He remains the majority shareholder following the merger with Broadstone.

“This is the most exciting time in aviation for almost a century,” Fitzpatrick commented. “Electrification will transform flying in the 21st century in the same way the jet engine did 70 years ago.”

Broadstone was founded by UK entrepreneurs Hugh Osmond, Marc Jonas, and Edward Hawkes who have managed investments worth more than £10 billion ($14 billion) over the past 20 years. They claim to have delivered an internal rate of return of 48 percent and an equity multiple of 3.5 over the past 20 years.

“Transportation is one of the next big sectors of the global economy to be disrupted at scale,” said Osmond. “Vertical has a clear commercial plan to challenge short-haul air travel and to create new markets where neither cars nor public transport can cope with demand.”